We target 0.6812 levels (i.e. 23.6% Fibonacci retracements from the highs of 0.7485 levels) which is sensible based on an assumption the Fed will hike in Dec and the further hiking cycle in 2017 is also on the cards, while the RBNZ may hold in short run but would keep door open for further cuts in the months to come.

However the persistent backdrop of global demand for high-yielding currencies is strong - if the Fed either doesn’t hike or signals very gradual tightening, then 0.75+ is likely instead.

The market is still underpricing the likelihood of a Fed hike by year-end. We expect further gradual dollar gains into the December FOMC meeting.

At the same time, the RBNZ is widely expected to cut rates for the final time in November, and that is already priced in.

Moreover, NZD/USD technicals are negative with the failure to regain the neckline of the head-and-shoulders pattern above 0.72. Short Kiwi would work particularly well if broader financial volatility were to rise from here.

OTC Updates & The Hedging Strategy:

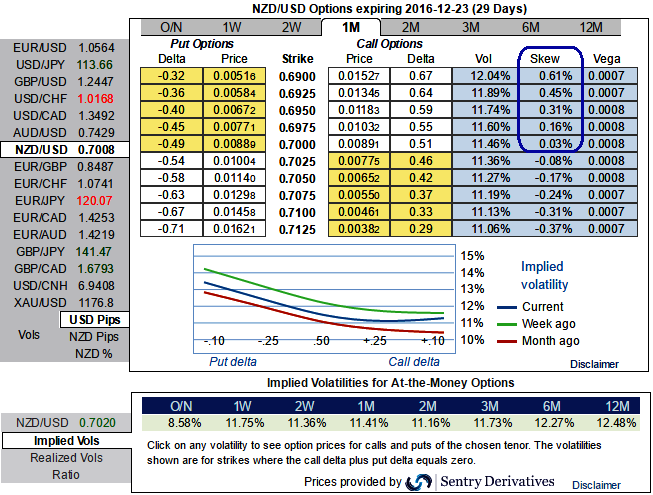

ATM IVs of this pair of 1-3m expiries are spiking at around 11.4 to 11.75%, and positively skewed 1m IVs signify the bears’ hedging interests for downside risks, while bullish delta risk reversal flashes negative numbers that is in sync with IVs.

If IV is in higher side amid bearish trend, then it would imply that the market ponders over the price has more potential for large downside movements.

Contemplating all these underlying factors, to arrest these downside risks we advocate initiating longs in 1m (1%) ITM put option with net delta -0.71.

Risk averse could also think of option strips strategy that was advocated in our recent write ups. The strategy reads this way: Go long in 2 lots of 1m ATM -0.49 delta put and simultaneously go long in 1 lot of ATM +0.51 delta call of the same expiry.

Rationale: Further dollar rally into December FOMC

The US dollar index rose to a fresh 14-year high early London but then retraced to be unchanged on the day.

The FxWirePro currency strength index for USD strengthened with positive flash that is the bullish signal, while NZD appears to be quite bearish. Intraday speculators could get benefitted by these flashes as this tool measures the hourly performance of domestic currency with the basket of other 7 currency peers.

Risk/return profile: No Fed cut and continued pro-carry macro environment, the key risks to the trade are that the RBNZ does not cut rates in November, the Fed does not hike by December, and the pro-carry global macro environment persists. The divergent policy expectations on the RBNZ and Fed are crucial for the trade to work.

In both cases of the option strategies, the maximum loss is to the extent of the premiums paid to enter into the option trades.

For more reading on our technical write up on this pair, refer below weblink:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data