NZ Treasury, budget, RBNZ and Fed hint on weakness in NZDUSD.

We still expect NZD/USD to weaken as NZ/US monetary policy diverges.

Furthermore, RBNZ doesn’t really seem to have eased their economy by reducing 25 bps OCR in last month end or it may take time to factor in this monetary policy decision as GDP (q/q), GDT price index, manufacturing PMIs have reduced considerably and unemployment rates have increased on the other side. Market pricing assigns a 50% chance of the RBNZ cutting on 9 June.

A recovery in export prices (and the terms of trade) would reduce the central bank’s sensitivity to the currency, support domestic incomes and help an eventual NZD recovery.

There were few surprises in the Budget.

The Treasury is forecasting very strong economic growth, large surpluses, falling net debt and low bond issuance.

We are sceptical. From 2018 the economy may be weaker than the Treasury is forecasting due to the wind-down of the Canterbury rebuild and a cooling of the current borrow-and-spend dynamic.

Furthermore, this Budget made no allowance for tax cuts. In reality, tax cuts are a possibility.

The policy announcements in today’s Budget were generally modest, and looked sensible to us.

The stronger fiscal position, and a renewed focus on debt reduction, has led the Government to slash its gross bond issuance programme by $8bn over the four years to 2020.

Inference:

Previously, the gross bond issuance programme was forecast to be $9bn a year for 2016/17 to 2019/20, but this has been cut to $7bn a year which indirectly would mean that even if RBNZ reduces OCR there is blockage fund inflow via slash in bond issuance programme which is likely to impact adversely on NZD.

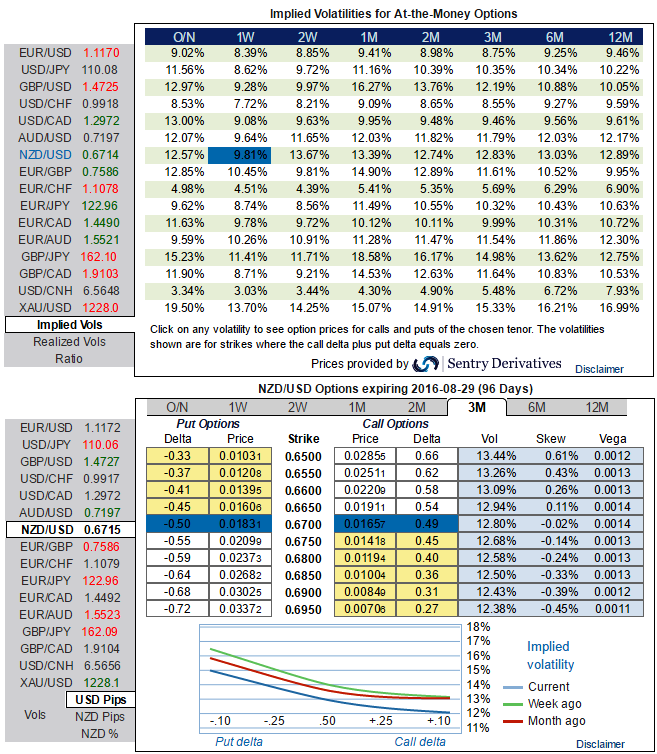

To substantiate our bearish stance, in OTC FX , IVs over longer tenors are stabilized with positive skews on OTM strikes, as you can observe.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics