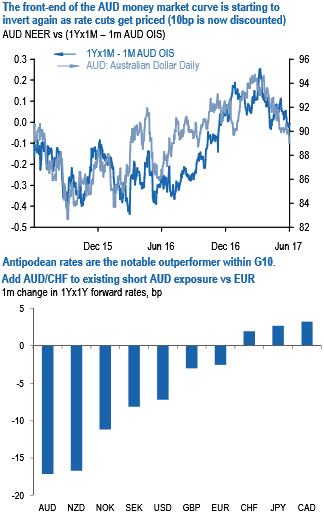

AUD money markets rates have rallied by more than any other G10 currency over the past month (see above chart). In the process, the front-end of the curve has inverted again as rate cuts have started to be priced again (roughly 10bp is now priced in – see above chart). The RBA is unlikely to offer any additional encouragement for rate bulls or AUD bears at next week’s policy meeting as we expect it to stick to its broadly neutral tone of recent months.

Nevertheless, we believe negative momentum in AUD is durable as this is being driven by a confluence of fundamental forces that are both diverse as well as persistent, namely evidence of a downturn in the domestic credit cycle that is manifesting itself in weaker housing market indicators and the performance of bank stocks, together with external factors including the ongoing slide in metals prices and the continued reservations about the Chinese growth cycle (the two are obviously in part inter-related). European currencies are on the other side of the cyclical divide and while growth expectations are no longer being upgraded as powerfully as they were, the delivery of strong growth in the region should sustain an ongoing upgrade in what remain structurally cheap currencies.

We see no reason not to include CHF in this category of undervalued currencies. We accept that this assessment is controversial but in support of this we merely cite the massive intervention the SNB has needed to undertake to prevent a more aggressive appreciation in the currency. Intervention this year is running at twice the pace of last year and nearly 70% greater than the current account surplus. Official intervention may constitute a-priori evidence of a currency undervaluation, but at the same time of course it also implies the currency is not free to appreciate so long as the SNB continues to sell.

What consequently is significant for CHF, and why we are increasing CHF exposure, is evidence that the SNB is finally tapering its intervention activities following the safe passage of the French election(what possible pretext would it have to intervene now that political risk has abated?). Average intervention over the past two weeks has dropped to only CHF 0.5bn. This is the slowest rate of intervention since last December and barely a fifth of the peak rate of intervention around the French election (chart 4). The official door for CHF appreciation seems ajar.

Sell AUDCHF at 0.7170 with a stop at 0.7320.

Stay long EURAUD from 1.4840 May 5th. Marked at +1.96%. Raised stop to 1.50.

Sold USDCHF at 0.9782 on May 18. Marked at +1.48%. Lowered stop to 0.9750

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge