Canadian data announcements have been lined up for this week, with unemployment data has disappointed as the number has risen to 7.8% from the previous 5.6%, while BoC monetary policy is scheduled on 15thfollowed by press meet, while retail sales and CPI flashes to print on 21st and 22nd respectively.

CAD softens on weak oil after OPEC+ cuts, but not enough. CAD is registering a small decline on the daily comparisons after spot nudged to the low 1.39 levels Friday while North America was closed and is rebounding in early trade now. CAD softness reflects the market’s dissatisfaction with the “historic” oil production cuts agreed by OPEC+ last week and its lack of impact on WTI (as large as the cuts are, they do not perhaps fully offset the demand destruction resulting from global slowdown).

PM Trudeau suggested that Canada may be able to loosen some lockdown conditions by the summer if social distancing measures continue to be restricted which rather implies that the recovery in the economy may be slower than had previously been thought.

USDCAD OTC Outlook And Options Strategy:

Given these concerns, it makes sense that CAD has decoupled from oil from the recent weeks as the focus on Canada's specific weaknesses grows larger. Despite the move lower in USDCAD this week, we maintain that directionality from here is higher in the pair.

Hence, add longs in USDCAD via options contemplating above fundamental factors and below OTC indications:

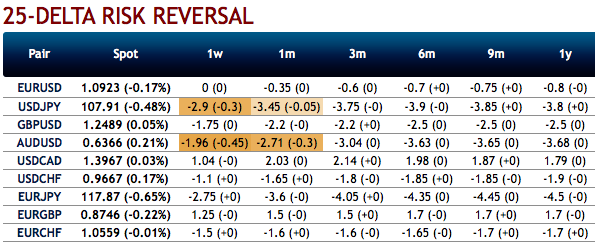

The existing bullish neutral risk reversal setup indicates the broader hedging sentiments for the upside price risks (refer 1st chart).

To substantiate this stance, the positively skewed IVs of 3m tenors are indicating the upside (refer 2nd chart), bids for deep OTM call strikes up to 1.44 levels is interpreted as the hedgers are inclined for the upside risks.

Hence, at this juncture (when spot reference: 1.3907 levels), we upheld our shorts in CAD on hedging grounds via 3-month (1.3815/1.45) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CAD recommendations. Courtesy: Sentry, Saxo & Scotiabank

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks