It was primarily the Brexit that cast its shadow over the Bank of England's monetary policy so far. The central bank had clearly signaled that normalization of its monetary policy over the medium term depended on an amicable outcome to the negotiations. But in view of global trends towards a looser monetary policy, this plan is now likely to be obsolete. Admittedly, some MPC members had recently still argued in the other direction, namely that the market could underestimate BoE interest rate hikes in the face of increased inflation risks. But even if there is no hard Brexit, it is doubtful that the BoE will raise its interest rates in the foreseeable future, while the Fed and ECB are moving in the opposite direction. The question that is more likely to arise is whether the BoE is not eventually following the trend and also considering a loosening. This would be a completely new burden for Sterling. At the same time, Brexit uncertainty, which will probably last until the end of October - the next Brexit deadline - is limiting the British currency's appreciation potential. Sterling bulls are facing truly hard times these days.

We know GBPJPY is the major trend is still weaker (see above chart) but the traders bother for the profit maximization.

It all depends on how much return that your strategy has fetched you when your trade convictions are right, not that how many times your trade guesses are right. Well, in that perspective, before proceeding further let’s just quickly glance at OTC outlook and suitable strategy for GBPJPY swings.

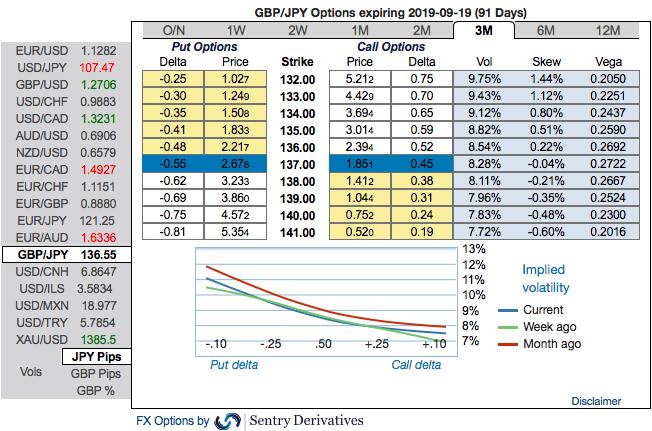

OTC outlook and Hedging Strategy: Please be noted that IVs of this pair that display the highest number among entire G7 FX universe.

While the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes upto 132 levels (refer above nutshells evidencing IV skews). Hence, it is wise to capitalize on momentary upswings of GBPJPY and deploy OTM put writing.

Accordingly, put ratio back spreads (PRBS)are advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on current abrupt and momentary price rallies and bidding theta shorts in short run, on the flip side, 3m skews to optimally utilize delta longs.

The execution: Capitalizing on any minor upswings , we advocate shorting 2m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options (spot reference: 138.19 levels).

The rationale for PRBS: The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1 or 3:2, to maximize returns as explained above. In most long/short spreads, you make money if the spot fx moves, but you lose if it remains in the middle “loss zone.”

Every underlying move towards the ITM territory increases the Vega, Gamma, and Delta which boosts premium. As you could observe spot GBPJPY keeps dipping, these delta longs would become in the money, while these derivatives instruments target further bearishness of this pair. Courtesy: Sentrix & Commerzbank

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing 53 (which is bullish), while hourly JPY spot index was at -27 (mildly bearish) while articulating (at 11:09 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close