The central bank events are delivering: BoC and ECB have been at the vanguard of reshaping non-US rate expectations this year, and their easing up on policy normalization rhetoric in October sparked good-sized spot swings in the immediate aftermath of meetings.

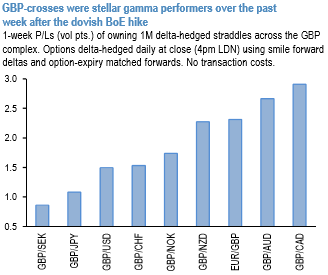

BoE was the latest to join the band of market-moving central banks this past week after its dovish hike pounded the sterling and led to solid gamma gains across the GBP-complex (refer above chart).

The BoE delivered a dovish hike – while rates are expected to rise, the pace of 2 further rate rises over the coming 3 years is glacial. It is therefore likely that the market will squeeze out rate rise expectations during 4Q as the market realizes how risk averse the MPC has become. The view of SG economics, that growth will drop to just 0.8% in 2018, points to downside growth risks. This should flatten front end spreads like 1-2y and 2-5y.

The outcome was not entirely unpredictable: we had noted last week that the mix of near-complete discounting of the November rate move, a heavily priced hiking cycle (100bp) along the Gilts strip and weak data flow in the build-up to the meeting in the context of Brexit uncertainty had raised the odds of sell-the-fact price action in GBP.

Sterling fell between 1% and 2% against its major counterparts and swaps dropped up to 9bp pretty much across the curve after the BoE MPC voted 7-2 to raise rates from 0.25% to 0.50%.

The rate rise is the first in ten years but was largely priced in which partly explains the liquidation of long GBP positions. Negative technical and seasonal factors aside, sterling forwards shaved around 7bp off the yield curve which is causing rate spreads to tighten in favour of the EUR and widen in favour of the USD. GBPUSD dropped below 1.3100 and EURGBP rebounded over 0.8900 having threatened 0.8760 earlier. Governor Carney did not comment on the exchange rate but cannot take much comfort in today’s fall in sterling which, if sustained, would keep inflation higher than desirable.

Currency Strength Index: FxWirePro's hourly GBP spot index has shown 15 (which is neutral), while hourly USD spot index was at 99 (bullish) while articulating at 09:06 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis