NZD faces domestic headwinds to local rates that are only now being fully appreciated. Growth has weakened, the central bank’s inflation forecasts have been revised materially lower, net immigration is slowing and business confidence has fallen significantly since the change of government.

Amid the lingering trade tensions between US-China that remain the market focus in the days to come, risks are to 0.67 by year end.

Over 2018, we see scope for some further under- performance from NZD, as we expect ongoing confirmation that the RBNZ can credibly lag policy normalization in the G3. Our RBNZ outlook (on hold until Nov 2019) is anchoring short-maturity interest rates and should keep 2yr swap rates inside the 2.10%-2.35% range.

The US dollar should strengthen further if the Fed hikes further this year, and that will push NZDUSD lower. In addition, the NZ-US interest rate advantage has been eroded, removing one of the previous attractions of the NZD. Further, domestic data is indicating the NZ economy is slowing.

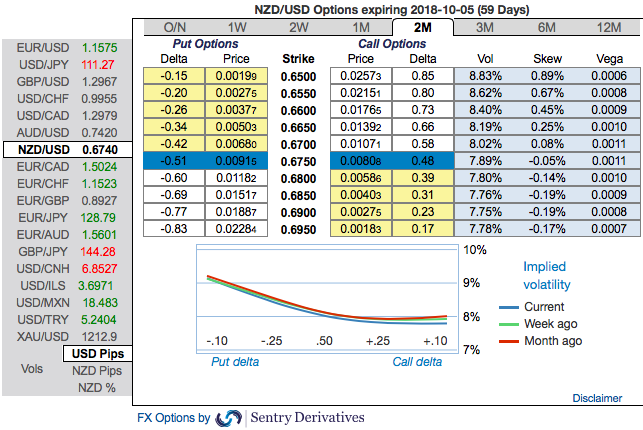

OTC outlook:

Most importantly, never disregard the signals of OTC market hedging sentiments, the positively skewed IVs of 2m tenors signify the hedgers’ interests for bearish risks. The bids have stretched for OTM put strikes upto 0.65 levels (above nutshell).

Accordingly, we advocate 2m (1%) in the money -0.79 delta put options, the rationale for choosing such derivative instrument is that the deep in the money call with a very strong delta would move in tandem with the underlying move.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by vega longs.

Currency Strength Index: FxWirePro's hourly NZD is inching at 30 (which is mildly bullish), USD spot index is flashing at -32 levels (which is mildly bearish), while articulating (at 09:08 GMT). For more details on the index, please refer below weblink:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics