No doubt from last two weeks, USDCNY has been spiking higher to the current levels of 6.5954 from the recent lows of 6.4345 levels.

However, it is foreseen that the strength of CNY can be traced to three factors:

The rebound in real GDP, higher commodity prices (which has aided the reflation theme and reduced pressure on the banking system) and higher interest rate differentials.

At the same time in recent months, our proxy of FX positioning data indicates that Chinese corporate USD selling interest has risen noticeably.

To the extent that this positioning adjustment is not yet complete suggests we could still further downside pressure in USDCNY in the near term.

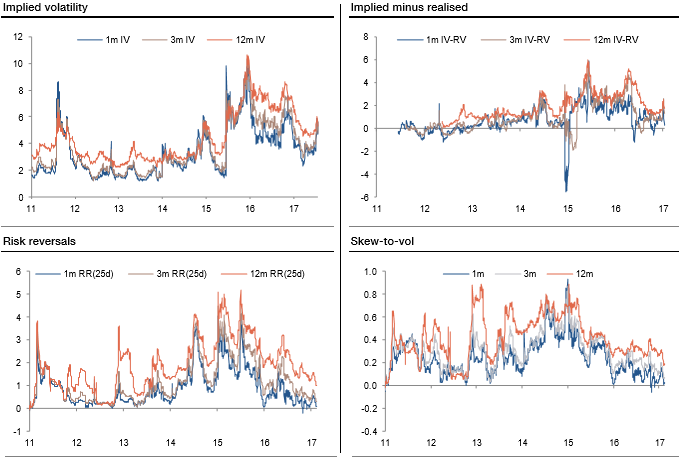

The implied volatility has bounced off the recent lows, the richness of implied versus realized vols has eroded; risk reversals and skew-to-vol are falling, term premiums have compressed while the vol smile has moved higher.

The base case scenario envisions CNH outperforming the forwards to year end.

However, a near term correction might ensue if EUR/EM FX falls or the Party Congress disappoints on the growth front. The PBoC has shown unease about USDCNH being much below 6.50. Topside exposure coupled with selling a downside strike (i.e. bullish seagulls) could be an appropriate structure.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?