We maintain our MXN forecast of 20.75 for end-2019 and neutral MXN in our GBI-EM portfolio. MXN has performed better than our expectation in December and January, but we expect it to start underperforming this year.

Despite much lower long MXN positions and high carry thanks to a hawkish Banxico, uncertainty regarding AMLO’s policies, combined with large foreign investments in Mexico, could cause MXN weakness this year.

The USMCA ratification process could also create some market noise, though we expect that it will eventually be ratified by all three countries.

Bearish scenarios of USDMXN at 20.0 if AMLO’s policies seem to put the country’s fiscal balance on an unsustainable path.

Bullish scenarios of USDMXN at 18.0 if Uncertainty lowers regarding AMLO’s policy mix and EM capital inflows resume.

OTC FX updates:

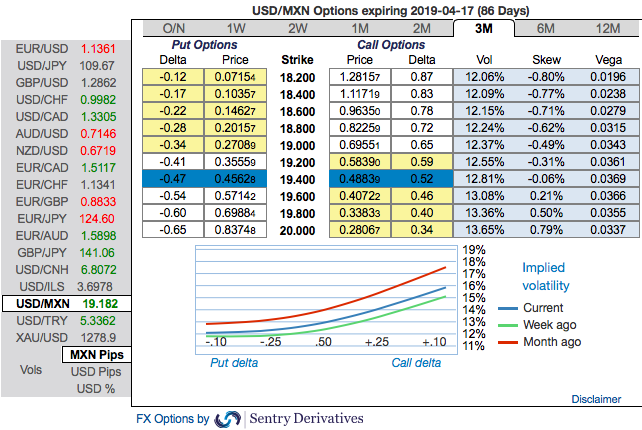

Please be noted that the 3m skews signal upside risks of this pair, hedgers’ bids up to OTM strikes up to 20.200 levels.

With the above in mind, we take the opportunity to analyze what generally works on the MXN vol surface, on a back-tested basis, and from a pure vol standpoint. The above nutshell explains a variety of structures for 3M maturities. For instance, selling RRs (delta-hedged) works orders of magnitude better than selling ATM vol. Better yet, 1*1.5 ratio USDMXN call spreads (delta-hedged) have been notably a high Sharpe Ratio (1.66) trade to hold over the years. Being long ATM vs. short OTM calls at near vega neutral notionals, the 1*1.5 ratio call spread structure is also well positioned to be selling topside OTM vols, which now are priced heftily after the latest vol explosion.

The peso sell-off triggered a vol surface dislocation, pushing gamma vols to 15.3 handle, the highest since June, and an even quicker reaction of front-end skews, reaching the highest since the 2016 US Presidential elections. The back of the vol curve is lagging the move, with 12M / 3M 25D risk reversals vol ratio at a multi-month low. Courtesy: Sentrix & JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at 159 (which is bullish) while articulating at (14:19 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise