China's yuan softened against the U.S. dollar on Friday and is set for its worst week in more than three months, dampened by weaker guidance and rising corporate demand for the greenback. In late May, the Chinese authorities let the yuan appreciate by more than 1 percent, a sizable leap for a currency that normally trades within a wafer-thin range and shed 6.5 percent to the dollar last year, as per the NASDAQ.

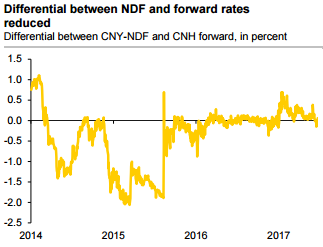

On the pursuit of optimal hedging, one may be tending to simply choose the tool that is cheaper. Even though the differences in the quoted prices between CNY-NDFs and CNH forwards have fallen notably since the PBoC started relying more on market forces in August 2015 (refer above chart) there are still price differences in 2017. In January these reached 0.7%.

Usually, the IVs (implied volatilities) in CNH is meager, but the economic difficulties in China but also the surprising institutional changes (e.g. to the fixing process) suggest that higher CNY volatility is likely to be the norm in the future.

Economize on premium-spend on carry trades using ratio call spreads that generate comparable returns to standard ATMF/ATMS option spreads but with lower premium outlay. USD put/Asia FX call ratios are well priced currently, with USDCNH the favored pick. However, if you’re skeptic on USDCNH vols (long option position needs higher IVs for significant change in Vega), alternatively, one can prefer other derivatives (preferably forwards).

However, a decision between these two tools should not be based exclusively on current price levels as a peculiarity of CNY-NDFs has to be taken into consideration: Usually, CNYNDFs are settled on the basis of the PBoC fixing, even though this approach is actually based on a misunderstanding. Even if everyone calls the PBoC’s quotation “fixing“ that is not what it is. A fixing would be a determination of the market rate (and would, therefore, be close to the spot rate).

Instead, the PBoC sets the mean of the acceptable USD-CNY fluctuation range on a daily basis - and following the recent introduction of a “counter-cyclical adjustment factor” completely at will. This mean rate is called “fixing” and is used to settle the NDF. Since 17.3.2014 the permissible fluctuation range by which the market rate can differ from the fixing is ±2%, so quite considerable.

Exemplary calculation: A USD-based importer who wanted to hedge receivables worth CNY 1m payable in two months’ time on 29th March 2017 (settlement date 31st May 2017) would have chosen a CNY-NDF at a rate of 6.8375 had he based his choice on the price levels at the time. Initially, that would have been USD 560 cheaper than hedging with CNH forwards (6.8114 at the time).

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons