The euro was able to recover slightly yesterday. This was due to the generally more positive market sentiment. This breather is likely to come to an end though, now that there is the risk of renewed escalation in the trade conflict with the US. The US administration has already prepared a list of tariffs which it intends to use against what it considers the EU’s illegal subsidies. Even if these tariffs are going to have the limited overall real economic impact they would nonetheless come at a bad moment, as the eurozone economy is already weakening.

European central bank is scheduled for this week, which is most likely to be unchanged. Any additional headwinds would further dampen the prospect of a rapid recovery and fuel speculation about further ECB measures. The euro is likely to continue struggling in this environment.

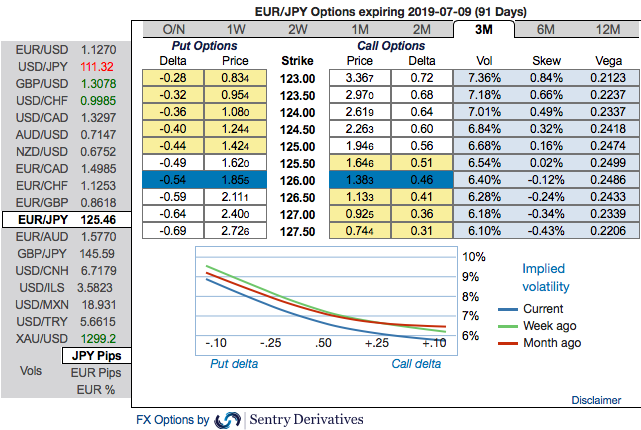

Hedge EUR-denominated income via risk reversals (RRs): Mild positive shift in risk reversal set-up and the bearish neutral RRs of all euro crosses (except EURGBP) across all tenors have still been signaling downside risks amid abrupt upswings.

We cannot afford to isolate hedging sentiment with this tool alone, this is evident while observing the 3m positively skewed IVs of EURJPY & EURUSD that are in line with the above-stated bearish scenarios. Skews stretched towards OTM put strikes signifies hedgers interest in the further bearish risks.

We see potential further USD strength and limited risk of significant USD weakening in the short-run, and notably, our EURUSD forecast is now running close to forwards on all horizons (vs previously above) and across tenors. Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 42 levels (which is mildly bullish), GBP is at -102 (highly bearish) while articulating (at 10:39 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation