According to reports, Finance Minister Gordhan would receive a ‘warning statement’ which indicates that he is about to be charged with an offence. This is most likely a politically motivated charge and consequently, we think political instability can increase substantially in South Africa. That’s bad news for ZAR and indeed for most ZAR denominated assets.

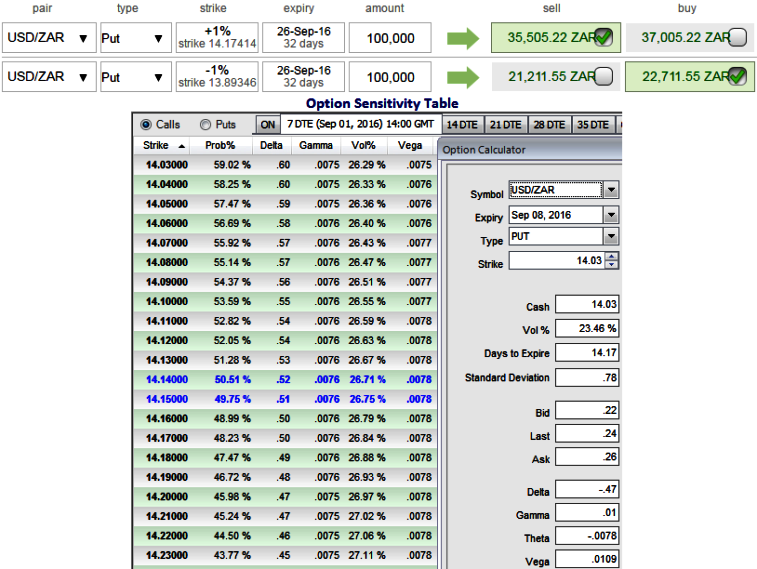

Stay Short in USDZAR: Current spot ref. at 14.0710, contemplating above political turbulence we recommend USDZAR shorts but with positional trades using diagonal credit put spreads (DCPS), targeting 8.5% move lower to 12.8749 in medium terms. We place a stop-loss 1% higher than current levels at 14.1741 9 (as shown in the diagram, one can also keep the tolerance levels of 1-2% extra).

Our trade horizon is 2 months. The position generates positive carry of about +60bp / month. Please be noted that the tenors shown in the diagram are just for demonstration purpose only, use narrowed tenors on the short side (preferably 2w or so would give you ideal entry point in the strategy). These diagonal option positions are likely to arrest both short-term upswings and long term downswings.

Risk Profiling: China, commodity prices, and FOMC constitute major risks Prominent risks to this recommendation include the resurgence of negative headlines from China, a collapse in hard commodity prices, and episodic fears regarding imminent FOMC rate hikes, or hikes occurring at a faster pace than anticipated.

Additionally, there may be domestic risks stemming from political infighting, labor unrest, and ratings downgrades. Bouts of profit-taking and consolidation may also undermine the position, while a lack of liquidity may additionally be a consideration for the trade, exacerbating moves in either direction.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data