New Zealand's upbeat GDP reduces prospects of OCR cut, so as US CPI for Fed hikes.

NZ produced the upbeat GDP QoQ numbers last week, actual 0.7% versus forecasts at 0.5%.

On the flip side, Fed’s deferral on rate hiking cycle due to various considerable reasons (especially US CPI, job market pressures and global slowdown) may hamper dollar prospects.

US CPI MoM prints at 0.2% versus forecasts at 0.3% and previous 0.4%.

As a result, if not in near terms we could foresee uncertainty on both sides of central banks who are likely to deliver changes in their respective monetary policies, as the long term downtrend has given trend reversal signal or it is just puzzling.

Well, technically although this pair has broken major resistances at 0.6896 levels and DMAs to evidence considerable price bounces further.

Hedging Framework: Spread ratio: (Long 1: Long 1: Short 1)

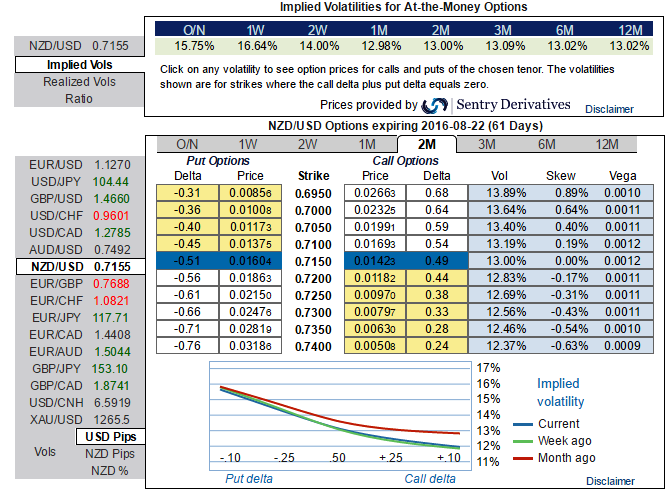

While the implied volatilities of 1m NZD/USD ATM call options are at 12.98% and likely to perceive at 13.09% in next 3m tenors.

With trend puzzling on either direction we like to advocate 3-Way Options straddle versus put option.

How to execute: Go long in NZD/USD 3M At the money delta put, Go long 6M at the money delta call and simultaneously, Short 1M (1.5%) out of the money puts.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed