Canadian GDP data is scheduled to be announced today, these prints on MoM basis likely to shrink a bit from previous 0.4% to 0.1% as per the consensus. While QoQ basis likely to post 2% which is well in line with the central bank’s target. The Canadian economy advanced 0.4% on quarter in the three months to September of 2017, following a downwardly revised 1% growth in the previous period.

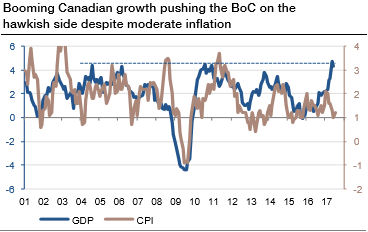

Solid growth to push the BoC on the hawkish side. Market pricing is currently similar for the BoC and the Fed, with the probability of two hikes in 2018 slightly above 30%. Indeed, the CAD has been boosted by the BoC's decision to raise rates to 1.25% from 1%, earlier than expected, on the back of a brighter-than-expected economic performance.

In our view, the market consensus is too gloomy on the drag to the Canadian economy from the housing market. While inflation has not yet reached the 2% target, growth indicators (consumer spending, employment) surprised on the upside, suggesting further monetary tightening (refer above chart) as Canadian real GDP is close to 3%.

While the local oil prices rise sustainably above $60/bbl triggering a renewed investment cycle that likely to cushion loonie.

OTC outlook and FX options strategy: Option strips (CADJPY)

CADJPY is one of the better candidates since recent CAD weakness has undershot recent moves in oil and rate spreads.

Well, please be noted that the positively skewed ATM IVs of 2m tenors indicate the hedging interests of OTM put strikes upto 80 levels.

Technically, we’ve already stated in our recent write-up that the current week prices tumbled well below 21EMA levels with flurry of bearish indications, such as 3-black crow candlestick pattern (which is bearish in nature), bearish DMA & MACD crossovers, broken wedge baseline with intensified bearish momentum, thereby, one could expect more slumps as both the leading oscillators have been constantly converging downwards to signal weakness. In this process, CADJPY spot FX has tumbled from 91.581 to the current 82.461, more dips seem to be on cards (refer our post on the technical section for more reading).

Well, to factor-in all above stated driving forces, we reckon that the underlying pair has equal chances of moving on either side but with more potential on the downside, accordingly, we’ve already advocated options strips strategy in the past.

We continue to reiterate it is wise to initiate longs in 2 lots of 2m ATM -0.49 delta puts, simultaneously, add long in 1 lot of +0.51 delta call of the same expiry, the payoff function of the strategy is likely to derive positive cashflows regardless of swings but more potential from the underlying spot FX moves towards downside.

The risk is limited to the extent of premium paid to buy the options.

The reward is unlimited until the expiry of the option.

Please note that the trader can still make money even if he was wrong, that means the strategy likely to derive handsome yields in premiums regardless of swings. But the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above -69 levels (bearish), while hourly JPY spot index was at 28 (mildly bullish) while articulating (at 07:27 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch