Gold price, so far in this year, has struggled amidst the market’s hawkish reconsideration of Fed policy as to how robust the growth and low unemployment have been, and the product of this policy amidst growth letting up in the rest of the world – a rallying dollar. A rising US yield curve has also been a dominant issue affecting markets this year.

The intent is foreseen from the Fed to deviate from its steady rate-hiking path and believe the Fed will hike 6 more times by the end of 2019 (two more hikes this year and four next), and expect the yield curve to rise and flatten at the same time, eventually inverting sometime after 1H’2019 (Treasuries: We now return to your regularly scheduled programming, Barry et al., 14 September 2018). Fed policy makers see fewer hikes, similarly projecting two more rate increases for the remainder of this year, but only three increases in 2019, which will then put the rate at a level where officials see policy as neither stimulating nor restraining the economy.

The futures markets, however, continue to under-price to both our and Fed’s forecasts, implying 44bp worth of hikes for the rest of 2018 but only 2 hikes in 2019, leaving plenty of room for another round or two of repricing.

Nevertheless, the market has been catching up and OIS markets are pricing in 62% of our Fed forecast through September 2019, up from just 47% a week ago. Courtesy: JPM

OTC Outlook and Options Strategies:

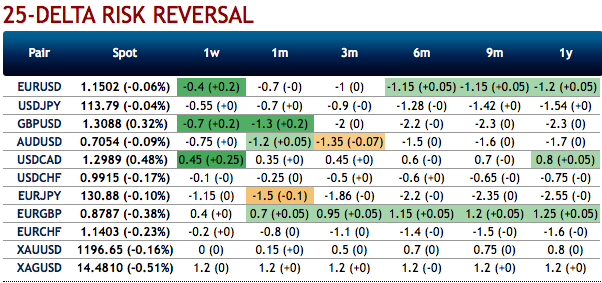

Bullish neutral risk reversals are observed in gold’s OTC hedging market, while positively skewed IVs of XAUUSD have been stretched out on either side. This is interpreted as the hedgers bid for both OTM calls and OTM put options.

Keeping above seesaw hedging sentiments under consideration, ATM straddles are advocated, while the strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2w tenors at net debit with a view of arresting potential FX risks on either side.

On hedging grounds, bidding bullish neutral risk reversals, buying (1%) in the money gold call options are advocated, an in the money call with a very strong delta would move in tandem with the underlying XAUUSD move.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -48 levels (which is bearish), while hourly USD spot index was at 4 (neutral) while articulating (at 12:03 GMT). For more details on the index, please refer below weblink:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures