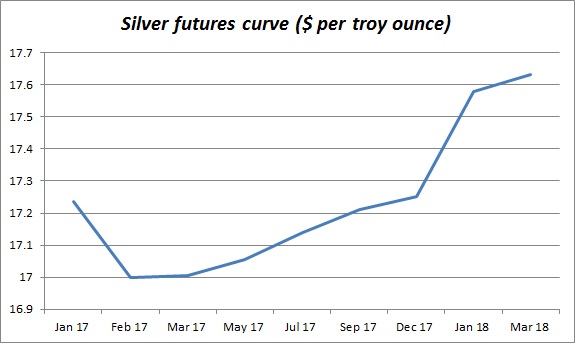

It is not very common for the precious metals to be in a backwardation, where the cash prices and the near-term future prices are higher than long-dated future contracts. However, as of now, both of these metals in a backwardation. January Silver Contract is currently trading at $17.23 per troy ounce, whereas the February contract is at $17 per troy ounce. It is not until December when the future contract is higher than the price in January. The financial market seems to be pricing a shortage of the white metal in 2017 while remaining confident about the supply meeting demand over the longer run.

Similarly, gold is also in a backwardation; however, that is much smaller than that in silver. The spot gold is currently trading at 30 cents premium to the January contract that is trading at $1201 per troy ounce. The backwardation should provide some support to the precious pack, however, they are not large enough to guarantee a steady rise in prices going ahead.

The chart shows silver futures curve.