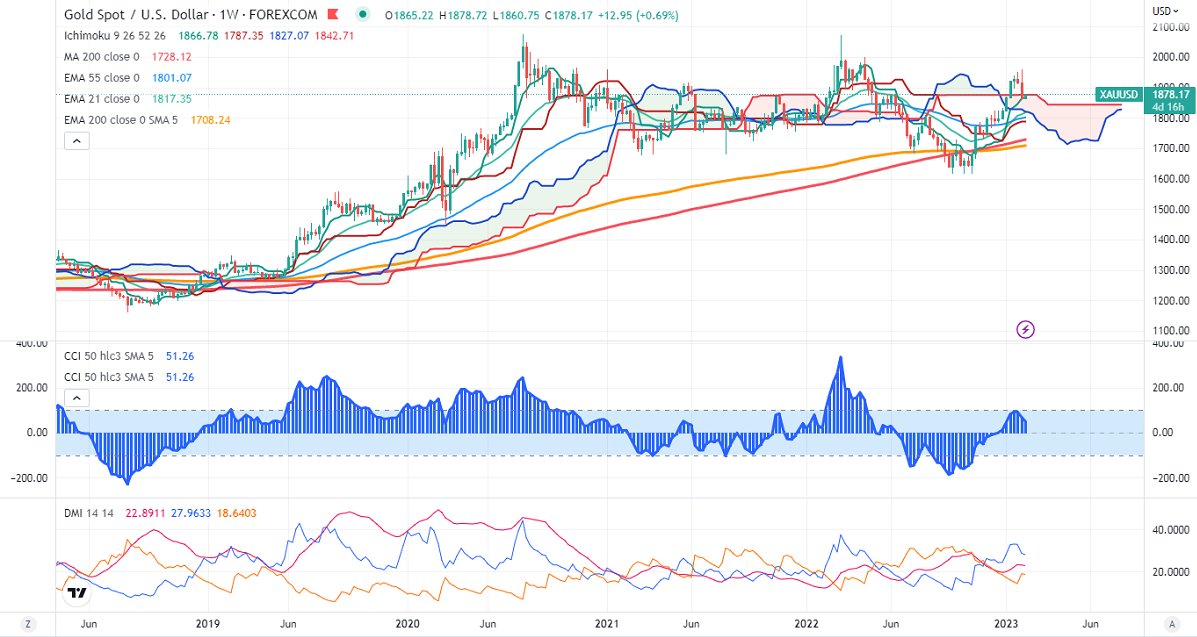

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1862.85

Kijun-Sen- $1787.35

Gold pared most of its gains after the upbeat US Non-Farm payroll. The US economy added 517000 jobs in Jan, much higher compared to a forecast of 185000. The unemployment rate came at 3.4% vs . Estimate of 3.6%. Average hourly earnings year-over-year declined to 4.4%, below analyst forecast of 4.9%some of its gains on profit booking. It hits a low of $1861.43 yesterday and is currently trading around $1877.80.

The number of people who have filed for unemployment benefits dropped by 3000 to 183000 week ended Jan 28, the lowest level since Apr 2022.

US dollar index- Bullish. Minor support around 101.50/100.80. The near-term resistance is 103.50/.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb dropped to rose to 97.4 from 84.2% a week ago.

The US 10-year yield jumped after US jobs data. Any break and close above 3.63% confirm minor bullishness. The yield spread between 10 and 2-year widened to -79 basis points from -72.40 bpbs.

Factors to watch for gold price action-

Global stock market- bearish (Positive for gold)

US dollar index – Bullish (Bearish for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1860, a break below targets of $1845/1828/$1800. The yellow metal faces minor resistance around $1880, and a breach above will take it to the next level of $1900/$1925/$1950.

It is good to sell on rallies around $1900 with SL around $1925 for TP of $1800.