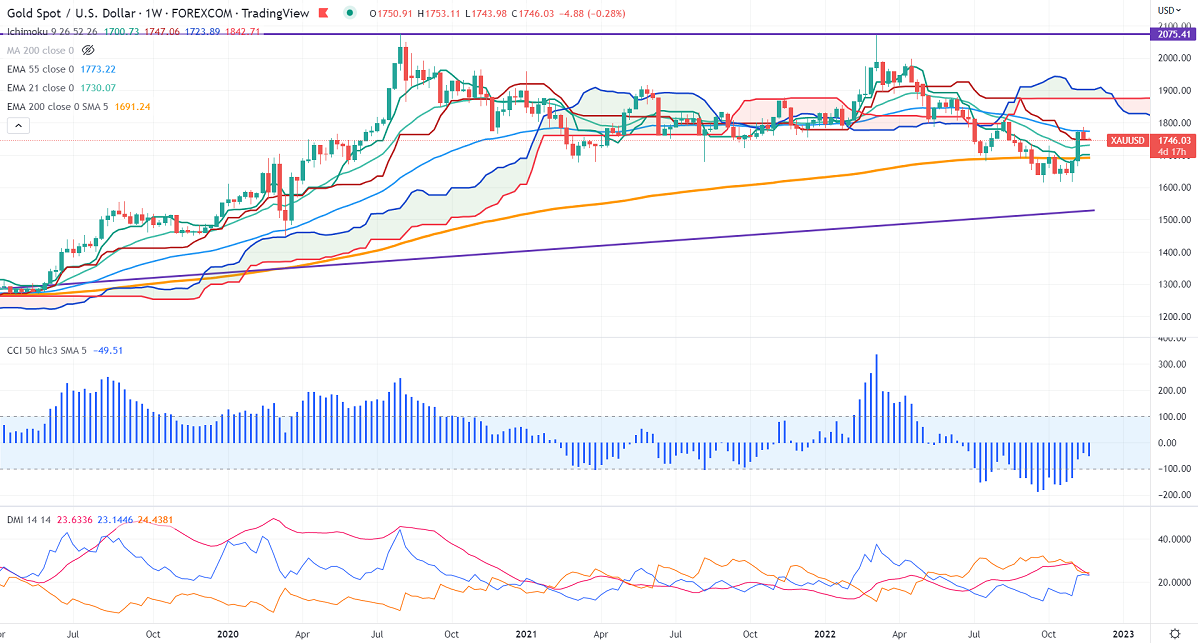

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1700.73

Kijun-Sen- $1747.06

Gold is trading lower for a fourth consecutive day on a strong US dollar. The dollar index gained momentum after hawkish comments from Louis Fed president James Bullard. It has surged more than 200 pips after forming a minor bottom at 105.34.

US retail sales rose 1.3% in Oct, above the estimate of 1%. October housing starts declined by 4.2% to a seasonally adjusted annual rate of 1425K from the previous month's 1493K. Building permits fell 2.4% in Oct, compared to a 1.4% contraction in Sep. The number of people who have filed for unemployment benefits eased to 222K for the week ended on Nov 11th vs. the forecast of 225K.US annual PPI declines to 8% in Oct, below the forecast of 8.3%. NY Fed manufacturing index urged to 4.5 in Nov vs -5 expected.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Dec increased to 80.6% from 75.8% a day ago.

The US 10-year yield recovered more than 4% after hitting a low of 3.671%. The US 10 and 2-year spread widened to -71 basis points from -57 bpbs.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1740, a break below targets of $1720/$1700/$1680. The yellow metal faces minor resistance around $1775, breach above will take it to the next level of $1800/$1840.Minor bullish continuation only if it breaks $1803.

It is good to sell on rallies around $1758-60 with SL around $1775 for TP of $1735/$1720.