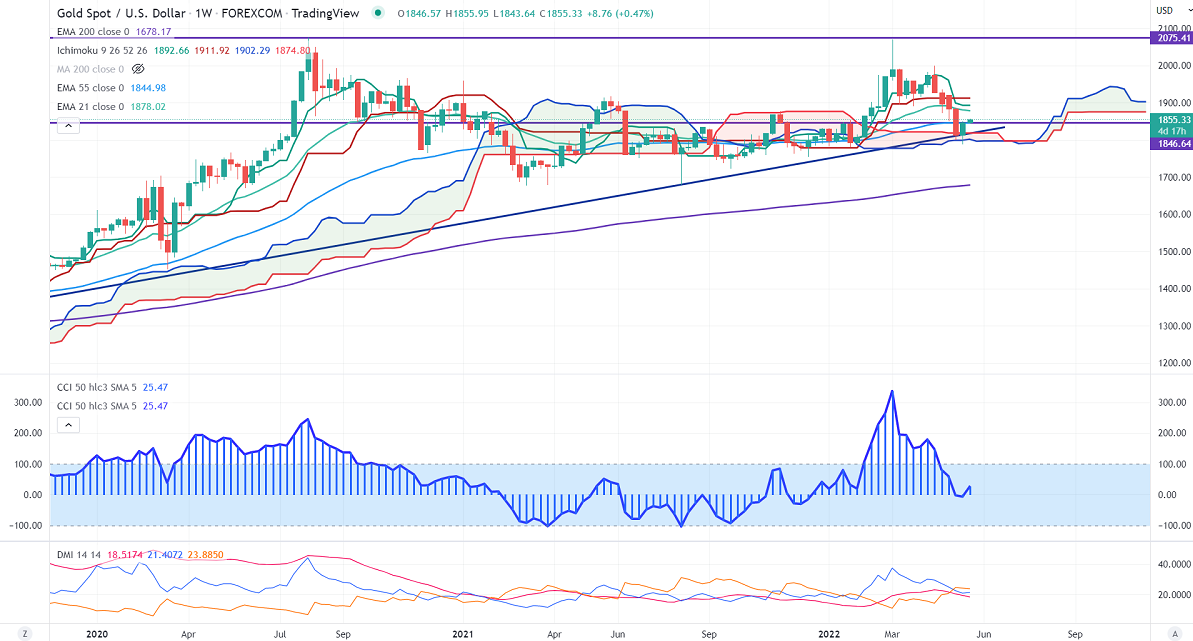

Ichimoku Analysis (Weekly outlook)

Tenken-Sen- $1892.66

Kijun-Sen- $1911.92

Gold gained more than $60 the previous week on weak US treasury yields. The spread of the Monkeypox virus in 15 countries outside Africa has increased demand for safe-haven assets like gold and the Swiss franc. It hits a high of $1849.25 and is currently trading around $1841.61.According to the CME Fed watch tool, the probability of a 50 bpbs rate hike dropped to 91.5% from 94.9% a day ago.

US Philly fed manufacturing index slumped to a 2-year low in May at 2.6 compared to a forecast of 14.90. Existing home sales dropped to 5.61M vs. 5.75M the previous month. The number of people who have filed for unemployment benefits rose to 218000 last week.US retail sales rose by 0.9% in Apr compared to 1%. Core sales jumped 0.6% vs. the Estimate of 0.4%.

Factors to watch for gold price action-

Global stock market- bearish (positive for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1830, a breach below targets $1820/$1800/$1750. Significant reversal only below $1750. A dip to $1700/$1689 is possible. The yellow metal faces strong resistance of $1862, any breach above will take to the next level $1880$1900/$1920.

It is good to buy on dips around $1840-41 with SL around $1818 for TP of $1900.