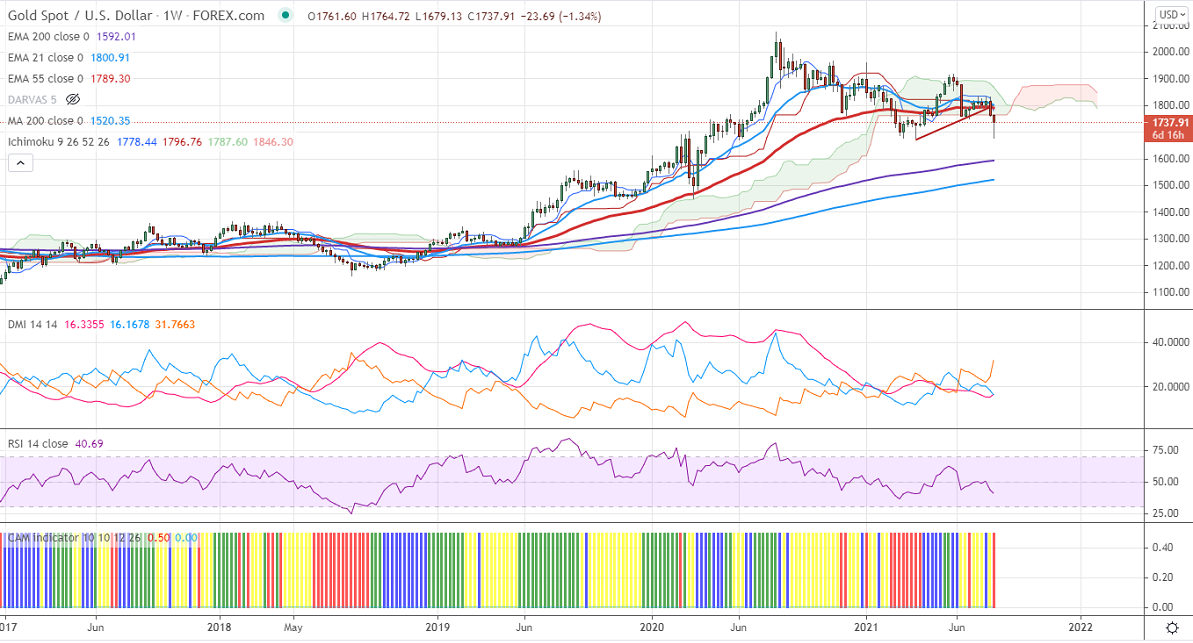

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1827

Kijun-Sen- $1796

Gold is one of the worst performers in the past week and lost more than $150 on board-based US dollar buying. The upbeat US jobs data has increased the chance of bond-buying tapering by Fed. The surge in US bond yields after jobs data also putting pressure on the yellow metal. It hits an intraday low of $1679 and is currently trading around $1739.

Economic data-

. The US economy has added 943000 jobs in Jul compared to an estimated 870000. While unemployment came at 5.4% vs the forecast 5.7%.The average hourly earnings jumped to 0.4% above the forecast of 0.3%. The number of people who have filed for unemployment benefits dropped by 14000 to 385000 for the week ended Jul 31st compared to forecast of 382000. US ISM manufacturing declined to 59.5 in Jul compared to a forecast of 60.9.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- slightly bullish (negative for gold)

Technical:

It is facing strong support at $1675 violation below confirms that the minor top has formed at $1916. A dip till $1600/$1550 is possible. On the higher side, near-term resistance is around $750 and a convincing break above will take the yellow metal $1768/$1785/$1800 is possible.

It is good to sell on rallies around $1750 with SL around $1765 for TP of $1675.