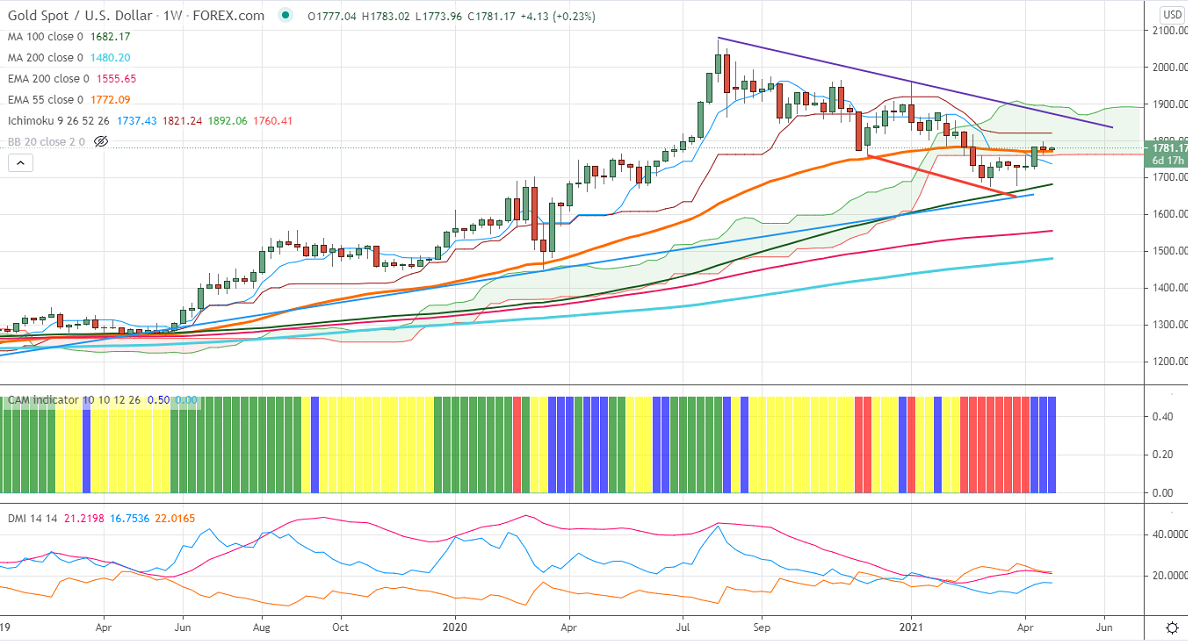

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1746

Kijun-Sen- $1821

Gold has shown minor recovery after hitting a low of $1770. The sell-off in the US dollar is supporting the yellow metal at lower levels. The US 10-year yield declined slightly after Biden proposed to double capital gain tax to 39.6%. DXY is trading well below 91 levels; any break below 90.60 confirms trend continuation.

Economic data:

The number of people who have filed for unemployment benefits in the US declined to 547000 lowest levels in 13 months, compared to a forecast of 607K. U.S existing home sales declined over 3.7% in Mar from a month before. Markets eye US Fed FOMC statement, advanced GDP, and Durable goods orders for further direction.

Technical:

It is facing strong support at $1760, violation below targets $1753/$1740/$1730. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1802, any indicative break above that level will take till $1821/$1832.

It is good to buy on dips around $1760 with SL around $1747 for the TP of $1793/$1802.