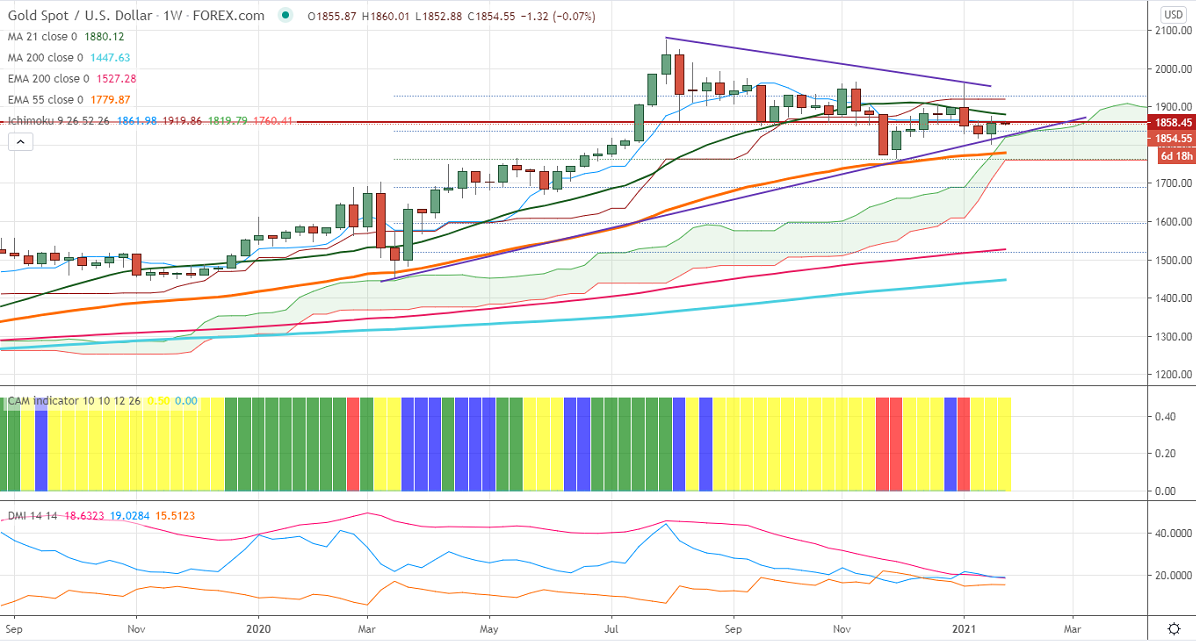

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1861

Kijun-Sen- $1919

Gold recovered sharply more than $50 in the previous week on the weak US dollar. DXY is struggling to break above 91 levels; any dip below 90 confirms a bearish continuation. The slight profit booking in the US 10-year yields amid stimulus and surge in coronavirus cases.

Economic data:

The number of people who have filed for unemployment benefits in the US has declined to 900K compared to a forecast of 900K. The Philly fed manufacturing index rose to 26.5 in Jan compared to the forecast of 11.20.

Technical:

It is facing strong support at $1846, violation below targets $1837/1820/$1800.On the higher side, near term resistance is around $1875, any indicative break above that level will take till $1885/$1900.

It is good to buy on dips around $1818-20 with SL around $1800 for the TP of $1900.