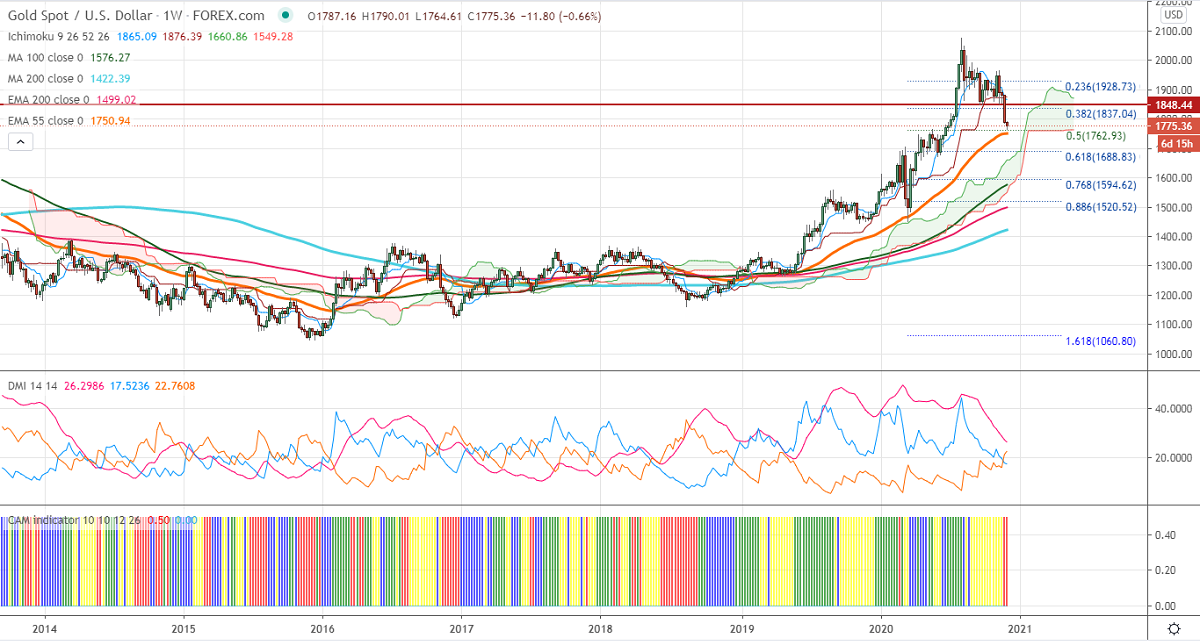

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1874.94

Kijun-Sen- $1872.90

Gold has broken major support of $1796 (200 – day MA) and holding below that level on COVID-19 optimism. The UK to clear Pfizer – BioNtech vaccine by next week. The upbeat market sentiment has decreased the demand for Safe-haven assets like the US dollar and gold. DXY hits the lowest level since April 2018, a dip till 90.80 is possible. The number of people infected due to coronavirus cases in the US crossed 13.75 million. The US 10-year yield declined more than 10%after a minor jump to 0.895%.

Economic data:

US durable goods order beats estimates of 0.5% while jobless claims surged to 778K vs forecast of 732K. The flash Q3 GDP came at 33.1% in line with expectations. Markets eye US ISM Manufacturing PMI and US Non-Farm Payroll data for further direction.

Technical:

In the Weekly chart, Gold is trading well below $1800 and any violation below $1762 will take the pair till $1750. On the higher side, near term resistance is around $1832 and any indicative break above that level will take till $1800/$1812/$1832.

It is good to sell on rallies around $1792-93 with SL around $1808 for the TP of $1700.