Gold was trading lower in previous 3after showing a jump till $1313. The decline was mainly due to strong dollar and easing geopolitical tension. US dollar index recovered more than 100 pips from low of 97.03.It hits low of $1274.73 and is currently trading around $1276.

US 10 year yield is still in bearish mode and any violation below 2.344% confirms further weakness. US economic data such as initial jobless claims and housing data came better than expected. Markets eye US FOMC minutes meeting for further direction.

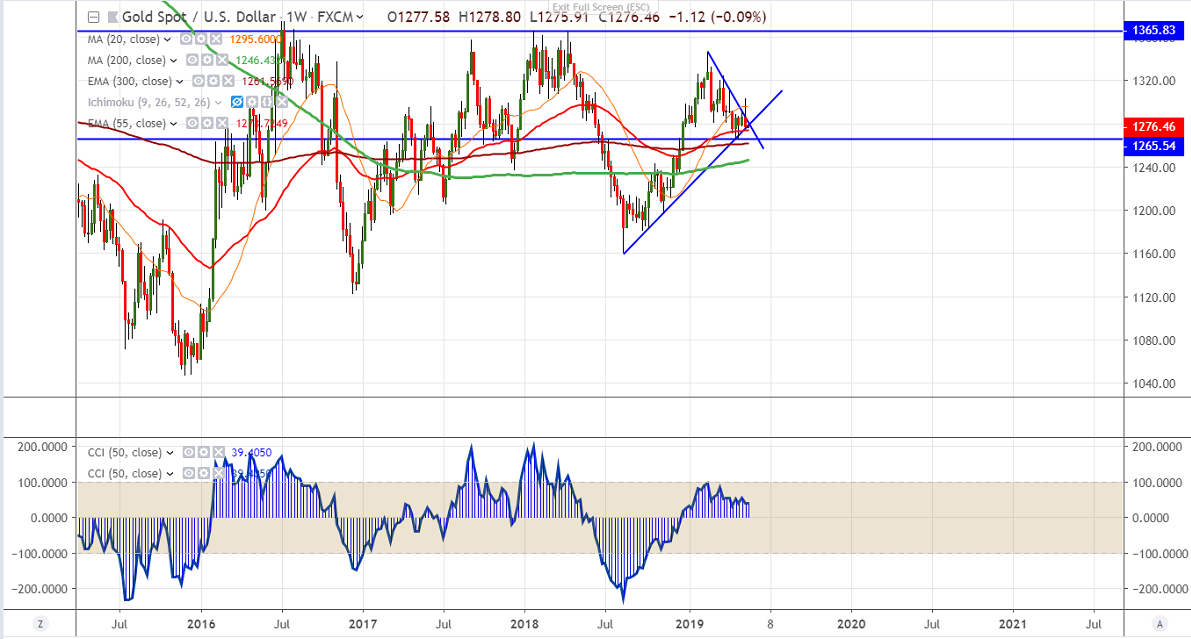

On the higher side, near term resistance is around $1282 and any violation above will take the yellow metal to next level till $1288/$1292/$1300. It should close above $1300 for further direction.

The near term support is around $1273 and any break below will drag the yellow metal to next level till $1266. Any major weakness only below $1266.

It is good to sell on rallies around $1282-83 with SL around $1292 for the TP of $1266.