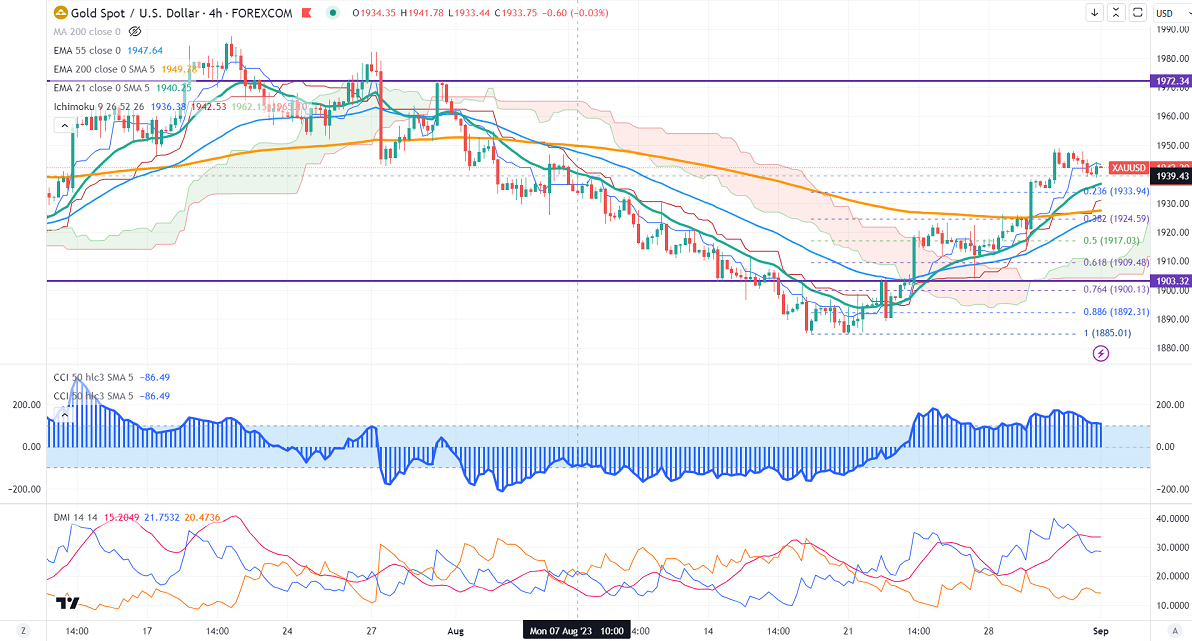

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1942.91

Kijun-Sen- $1926.46

Gold trades flat ahead of US nonfarm payroll data. It hit a high of $1949.07 and is currently trading around $1942.46

US core PCE rose to 4.2% at an annualized rate of 4.2%, compared to a forecast of 4.1%. Every month, the core PCE index came in line with the estimate. The number of people who have filed for unemployment benefits declined by 4000 in the week ending Aug 26th vs. an estimate of 232000.

Sep 1st, 2023, 2023, US nonfarm payroll (12:30 pm GMT)

Unemployment rate

US dollar index- neutral. Minor support around 103/102. The near-term resistance is 105/106.

According to the CME Fed watch tool, the probability of a no-rate hike in Sep increased to 89% from 81% a week ago.

The US 10-year yield consolidates in a narrow range ahead of US jobs data. The US 10 and 2-year spread narrowed to -75% from -86.4%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Neutral (Mixed for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1933, a break below targets of $1920/$1900. The yellow metal faces minor resistance around $1950 and a breach above will take it to the next level of $1970/$2000.

It is good to buy on dips around $1932-33 with SL around $1920 for TP of $1970/$2000.