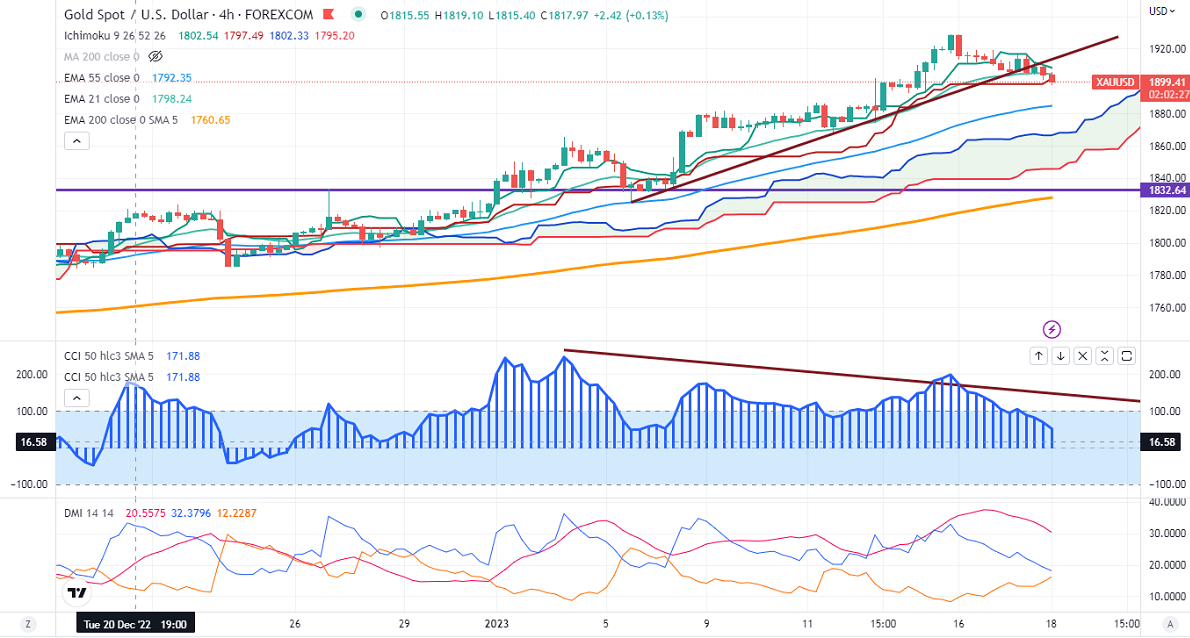

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- $1910.06

Kijun-Sen- $1898.15

Gold pared most of its gains on the weak yen. The US dollar gained momentum against Yen Post BOJ monetary policy. The central bank has kept its yield curve control policy unchanged. USDJPY gained more than 2% after the dovish policy by the Bank of Japan. Gold hits a low of $1897 and is currently trading around $1898.94.

Markets eye US PPI and core retail sales data for further direction.

US dollar index- Bearish. Minor support around 101.50/100. The near-term resistance is 103.50/104.50.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb rose to 94.70% from 76.70% a week ago.

The US 10-year yield pared some of its gains after hitting a high of 3.585%. Any break and close above 3.40% confirms minor bearishness. The yield spread between 10 and 2-year widened to -70 basis points from -46.9 bpbs.

Factors to watch for gold price action-

Global stock market- bullish (bearish for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1890, a break below targets of $1865/$1825.The yellow metal faces minor resistance around $1935, and a breach above will take it to the next level of $1950/$1969.

It is good to sell on rallies around $1905-06 with SL around $1920 for TP of $1860/$1825.