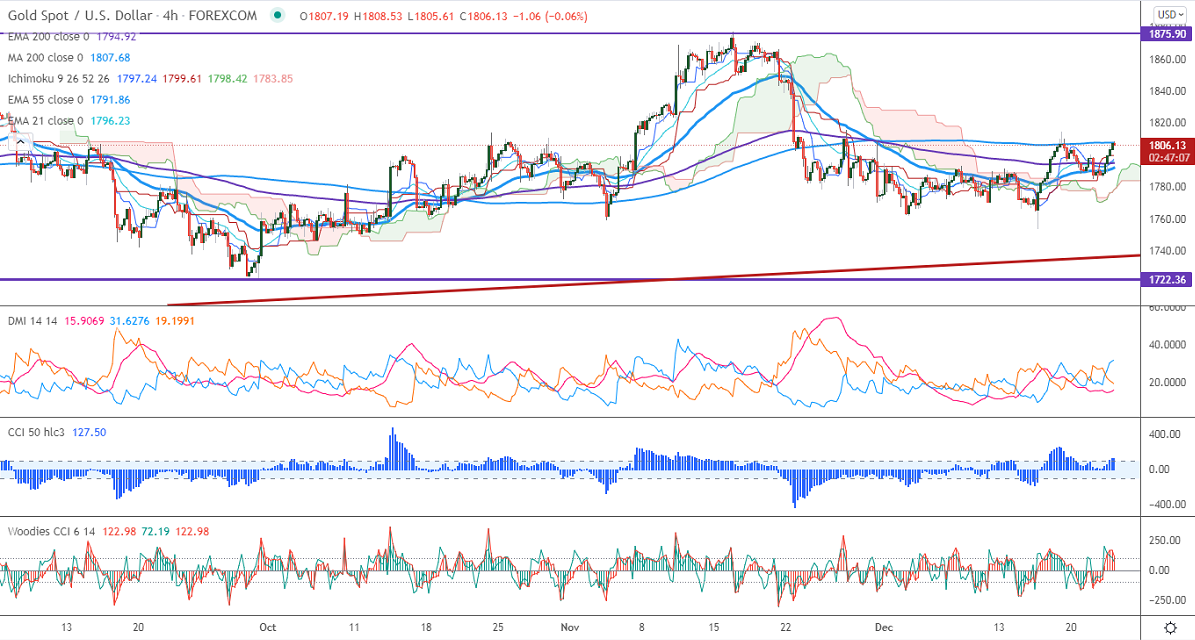

Ichimoku analysis (4-hours chart)

Tenken-Sen- $1796.09

Kijun-Sen- $1799.45

Gold recovered above $1800 after hitting a low of $1784 level on dollar weakness. The spread of omicron across the globe also supports yellow metal at lower levels. The US dollar index almost formed a double top around 96.65 and showed a decline of more than 50 pips. US economy expanded at an annual pace of 2.3% compared to a forecast of 2.1%. US Consumer confidence rose in Dec to 115.8 in Dec vs estimate 111. It hits an intraday high of $1808.50 and is currently trading around $1806.55.

Factors to watch for gold price action-

Global stock market- Bullish (Negative for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

It faces strong support at $1780, violation below targets $1770/$1750/$1740/$1700.Significant trend continuation only below $1675. The yellow metal facing strong resistance $1815, any violation above will take to the next level $1835/$1860/$1900 is possible.

It is good to buy on dips around $1801-02 with SL around $1790 for TP of $1835.