Sterling was the top performer in our sample this week, based entirely on the UK snap election announcement. The market bid sterling in the expectation that an enlargement of the Conservative majority in the UK parliament will facilitate a smoother negotiated Brexit. The euro also did well as nervousness about Mélenchon’s rise eased after he consistently failed to break through 20% in the opinion polls. On the other hand, crude oil prices tumbled this week, and this dragged down the oil-linked CAD and NOK. Weaker-than-expected Canadian inflation data added to pressures on the loony. AUD was pressured in the first half of the week by a further drop in iron ore prices.

The euro also did well as nervousness about Mélenchon’s rise eased after he consistently failed to break through 20% in the opinion polls.

On the other hand, crude oil prices tumbled this week, and this dragged down the oil-linked CAD and NOK. Weaker-than-expected Canadian inflation data added to pressures on the loony. AUD was pressured in the first half of the week by a further drop in iron ore prices.

Flows and liquidity:

Some modest de-risking appears to have taken place over the past month or so ahead of the French presidential election, similar to what had happened before ahead of the Brexit referendum and ahead of the US election.

Discretionary rather than Systematic managers appear to have driven the de-risking. The de-risking was also evident in ETF flows.

Gold, Utilities, Staples and EM bonds saw more ETF inflows per day during April than during the first quarter. The ETFs of US equities, Japanese equities, Financials, Energy, Industrials, and Materials all saw outflows in April vs. inflows in Q1.

Brent, Gasoil, Copper, Platinum and Corn are very close to switching currently and thus at risk of experiencing volatile swings induced by trend-following/CTA strategies.

Two months after our original analysis, we still find that European political risks are priced in asymmetrically across asset classes with a still high interest in shorting French government bonds and avoiding European equities.

But previous extreme European bank underweights have been cut by half.

And while the previous modest short base in the euro has been covered, investors have been reluctant to go long the euro.

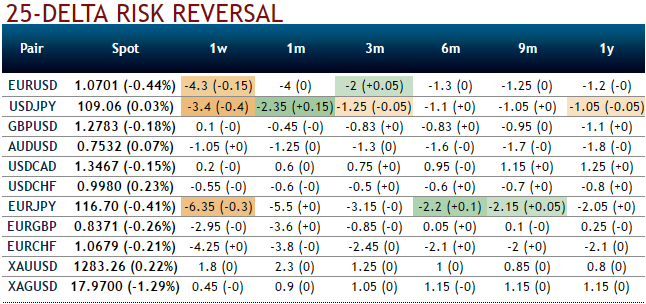

EUR crosses are making more noise in OTC market amid elections season, while bearish GBP hedging sentiments remain intact despite momentary rallies as domestic and geopolitical developments remain front and centre at the moment, with the UK snap election announcement, yesterday’s French election, Trump’s upcoming 100-day anniversary and a special EU Brexit Summit (both Saturday) giving markets plenty to ponder.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings