A glimpse at driving forces: The CAD has struggled to improve clarity in this low-volume ahead of today’s BoC monetary policy that is most likely to hike its overnight rates by 25 bps, there are some constructive factors in addition to this monetary policy stimulus that should see more progress emerge in the coming week. Markets remain concerned by trade risks as tit-for-tat tariff measures were implemented this week. However, it is reckoned that the recent price action implies that a fair amount of negative judgment has already been applied to the CAD in this respect.

The adverse news might already be priced in. We note that relative data surprises are no impediment to a somewhat stronger CAD and, with spreads and commodities all showing positive correlations with the exchange rate, we would expect closer tracking – all else being equal – between the market and our high frequency fair value model, which is reflecting an equilibrium estimate of a little above 1.30 this morning. In the longer run, we reiterate that a significant improvement in Canadian terms of trade remains an under-appreciated – and quite significant – the fundamental plus for the CAD.

OTC Outlook and Options Strategies:

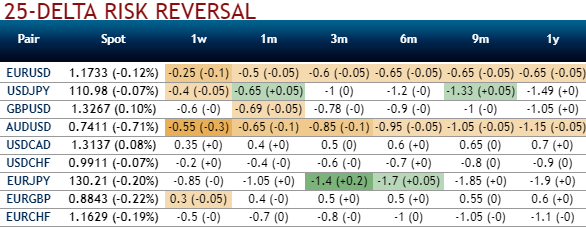

Before we move onto strategies, let’s just glance through the risk reversals of USDCAD across all tenors that are showing no changes, while IV skews of 1m expiries still signal bullish hedging bids. The positively skewed IVs imply that the bullish risks remain intact despite the above stated fundamental factors.

While 1m forward rates show negligible changes and bearish targets in the longer tenors.

Accordingly, we uphold staying short USDCAD through a low-cost RKO: The USDCAD put RKO was originally conceived as a low-cost option to gain exposure to what seemed like a decent chance of a near-term breakthrough in NAFTA negotiations.

Now what seems most likely is that the option will expire worthless, particularly after the latest developments in the US Trade policy which seemingly swung the tone of NAFTA negotiations back to an antagonistic one where Trump has once again publically hinted about the possibility of pulling out.

Hence, we advocate staying short in 1w USDCAD forwards with a view to arresting potential bearish risks in the near-term and longs in 3m forwards.

Alternatively, Buy 2m 1.31 USDCAD put, RKO 1.27, spot reference: 1.3163.

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 56 levels (which is bullish), while hourly USD spot index was at 83 (bullish) while articulating at (11:13 GMT). For more details on the index, please refer below weblink:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch