BoC (Bank of Canada) monetary policy is scheduled for today, the policy expectations have firmed up in the past week or more and the LFS data added some incremental conviction for a hike on Jul 11th.

The breakdown (full time/part time) looked a little mixed but a breakdown of the breakdown (by sector) shows encouraging signs – a rebound in construction jobs and the first growth in manufacturing employment this year. Market pricing reflects around 87% of a 25bps hike priced in now.

This is an MPR meeting and there will be a press conference afterward; messaging around the rate outlook will therefore count.

The Governor recently noted clearly that given where the economy is, higher rates will be warranted so markets will want to assess where the policy risks lie over the balance of the year.

We anticipate a 25bps tightening next week and another later this year (to get to 1.75% for end 2018). Our end 2019 target is 2.50%.

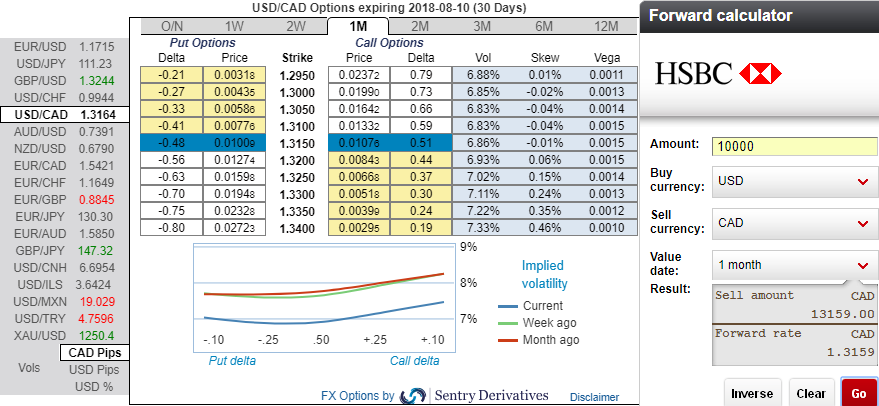

Ahead of today’s Canadian bank’s monetary policy, let’s just glance through the risk reversals of USDCAD across all tenors that are showing no changes, while IV skews of 1m expiries still signal bullish hedging bids. The positively skewed IVs imply that the bullish risks remain intact despite the above stated fundamental factors.

The future volatility determines option pricing, yet it is impossible for any veteran in FX markets to anticipate accurate future volatility. Nevertheless, it is quite possible to ascertain the marketplace’s expected future volatility using the option’s price itself. This is known as implied volatility (IV) and, due to the nature of its calculation, it is theoretical. If IV is high, it means the market thinks the price has potential for large movement in either direction. Low IV implies the market reckons the price would not move much.

While 1m forward rates show negligible changes and bearish targets in the longer tenors.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above 26 levels (mildly bullish), while hourly USD spot index was at 154 (highly bullish) while articulating (at 10:44 GMT). For more details on the index, please refer below weblink:

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges