Technically, we have come across with enough bearish swings to steep downwards along with upper trend line of the falling wedge formation while plotting both weekly chart with mammoth volumes show the tendency to confer trend line on monthly charts as well.

The pair has evidenced steep slumps about 1.70% or 250 pips exactly within 1 month.

However, the IVs of ATM contracts of GBPUSD are still perceived to be below 8%, it is featured as the one of the top 3 currency crosses to perceive the least IVs within next 1w-1m time frame among G7 space (at around 8-8.5%):

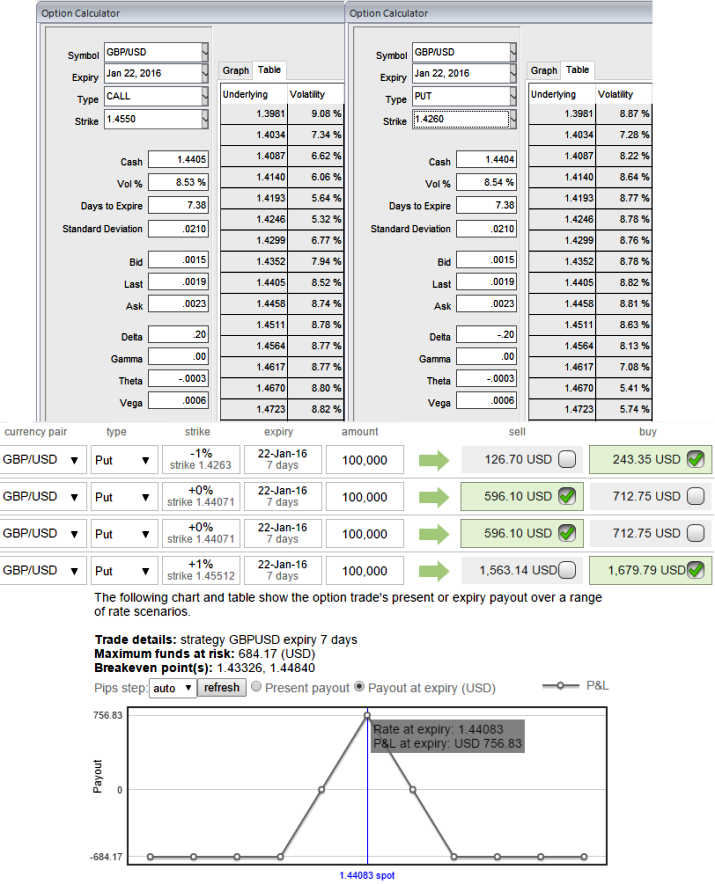

As you can see in the diagram, while GBPUSD Spot FX is at 1.4405,

1% OTM put = 8.54%

1% OTM call = 8.53%, thereby no much disparity exists.

Thus, the risk reversals of ATM contracts of 1-month maturities have no significant disparities between at the money and out of the money instruments (compare delta risk reversal with above computation of OTM instruments).

So, no panic for bears, even if we may see some abrupt bounces as major trend seems to be strongly bearish in long term, the above diagram showing IVs and risk reversals computations would imply that OTC market sentiments are fairly balanced with hedging arrangements to mitigate forex risks onn either side.

Formulation of Option Strategy:

Currently the pair is trading at 1.4405 with volatility of ATM contracts marginally inching lower (towards 8%), hence, the recommendation on buying 2W (-1%) OTM -0.17 delta put while simultaneously shorting 3D ATM put and buy 2W (1%) ITM -0.84 delta put while simultaneously shorting another 3D ATM put. This strategy is structured for a larger probability of earning a smaller but certain profit as GBPUSD is perceived to have a low volatility.

The highest return for this strategy is achievable when the pair at expiration is equal to the strike price at which at the money options are sold. At this price, all the options expire worthless and the options trader gets to keep the entire net credit received when entering the trade as profit.

FxWirePro: GBP looks vulnerable against dollar, deploy butterfly spread as risk reversal and IV signals cable may go sideways

Friday, January 15, 2016 6:19 AM UTC

Editor's Picks

- Market Data

Most Popular