As for monetary policy, we remain to be convinced that a modest increase in UK rates over and above what is now priced (we expect 50bp this year) will be a game-changer for GBP. Growth may have improved in the UK but the country is still a clear laggard within G10 and monetary tightening is merely reducing the highly negative level of real UK rates. The Brexit vote may not have reduced the current account deficit to a more normal level notwithstanding the collapse in GBP (the deficit is currently averaging 4.5% of GDP), but it has led to a collapse in long-term capital inflows and so presents the UK with short-term financing requirement of around 5.5% of GDP.

The rate of inflation across the UK stood at 3% in January 2018, unchanged from the previous month and above market expectations of 2.9%. Sterling seems to be bearish as UK CPI peaks and wage growth fails to accelerate to 3%.

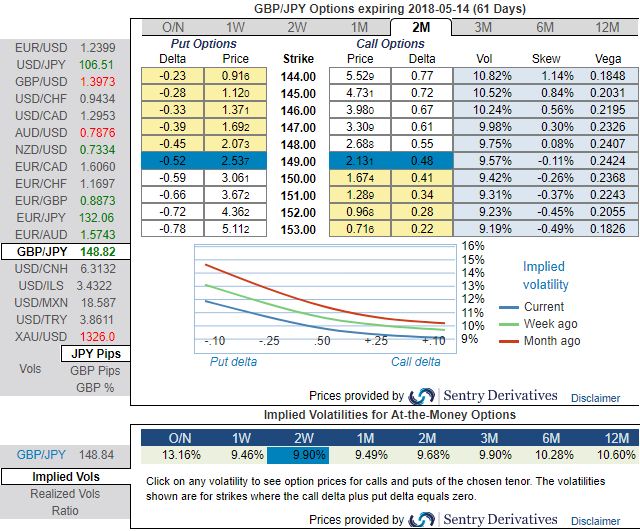

Well, ahead of UK CPI and BoE monetary policy, please be noted that the positively skewed IVs of GBPJPY of 2m tenors signify the hedgers’ interests in OTM put strikes (upto 144 levels) and isn’t this a luring factor for a shrewd bear. While 2w/2m IVs of ATM contracts are trending above 9.90% and 9.68% respectively that are the suitable combinations for diagonal put ratio spreads.

Because the higher IVs with well-adjusted positive skewness signify the hedgers’ interest for both OTM call/put strikes. In usual circumstances, long option position needs higher IVs for significant change in vega. Hence, we capitalize on buzzing IVs in 2m tenor for long leg and improve odds on options below strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility. Thus, ATM strikes are perceived to be more conducive than the OTMs.

Further GBPJPY upswings and/or weakness suggest building directional strategies as given below and volatility patterns at the same time.

1) In order to mitigate the mounting downside risks and keep them on the check, we advocate adding longs in 2 lots of ATM -0.49 delta puts of 2m tenor while writing 1 lot of 2% OTM put of 2w tenor.

Contemplating IV skewness and ongoing technical trend, we foresee the value of ATM options would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

2) Dubious and risks averse traders, we advocate buying GBPJPY – USDJPY 1Y ATM straddle spread with equal JPY vega.

3) Alternatively, on hedging grounds, we advocate shorting futures contracts of near-month tenors as the underlying spot FX likely to target southwards 144 levels in the near run and 142 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned into 41 (which is bearish), while hourly JPY spot index was at shy above 9 (neutral) while articulating (at 07:02 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September

Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September