This has been a year of lower vols, especially among FX space. Just glance at the OTC FX markets, shrinking implied volatilities (IVs) are luring options writers. Please observe USDCHF, GBPCHF, and EURCHF are showing lower IVs despite the schedule of SNB’s monetary policy event for this week.

This may be because the Swiss National Bank (SNB) has been maintaining the status quo in its monetary policy to leave everything unchanged (kept libor rate at -0.75%). Consequently, the development of CHF over the past weeks did not seem to have provided any reason to tighten the monetary policy reins after all. With lingering uncertainty over the Italian budget conflict and Brexit, CHF seems to be much more in demand again recently. During such a circumstance that the SNB does not want to give the FX market any other arguments for trading the franc at stronger levels, which would put pressure on the inflation outlook and domestic exports.

The medium-term fundamental factors which support CHF are still intact in our opinion, even if they comprise relatively slow-moving, structural forces which may not be observable day to day. Chief amongst these is Switzerland’s structural balance of payments disequilibrium, by which we mean the combination of an excessive current account surplus and inadequate private sector capital outflows to recycle the surplus. This disequilibrium has become more acute over the past year resulting in upside pressure on the franc.

Please be noted that GBPCHF's major downtrend remains intact (refer above chart), technically, although you see some mild rallies in the short run, downswings (at 1.2660 levels while articulating) are likely to extend after sliding below 21EMA on the occurrence of bearish engulfing pattern, both trend & momentum oscillators on the bearish bias.

OTC Outlook and Options Strategy:

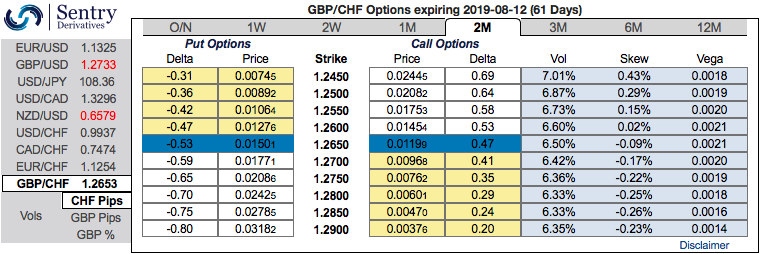

GBPCHF is showing lower IVs at 6.55%, while hedging activities are seen for bearish risks.

Most importantly, positively skewed IVs show bids for OTM put strikes that signal downswings risks, so we believe any short upswings are the best advantage for bears and would be utilized for writing ITM puts amid shrinking IVs in short hedging strategies so as to reduce the hedging costs. (Compare delta risk reversal with last week).

The pair is likely to perceive implied volatility close to 5.76% of 2W ATM contracts, 6.55% in 2m tenors, thus we recommend deploying short put ladder spreads that contains proportionately less number of shorts and more longs which would take care of potential slumps on this pair and significantly higher volatility times.

This would mean that market sentiments for this pair have been bearish for this pair. As a result, we reckon that for the next 2 months’ time CHF may pretty much gain out of lots of manipulations and ambiguities are surrounding around GBP.

Thus, short ITM put with shorter expiry since implied volatility is inching higher when risk reversals are lesser comparatively to 1M expiries which is good for option writers in next 1 week, so the strategy goes this way, go long in 2 lots of ATM and OTM put with longer expiry (per say 2M expiries) and simultaneously short 2W ITM puts with positive theta values. Courtesy: JPM & Sentrix

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 97 levels (which is bullish), and hourly CHF spot index has bearish index is creeping at -16 (mildly bearish) while articulating (at 11:51 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays