The Fed was first out of the blocks with a strong policy response to the global financial crisis, while the election of Shinzo Abe as Prime Minister of Japan brought the BoJ into the fray, and by the start of 2015, the ECB had joined in and a significant dollar rally was underway.

A few more central banks tiptoe to the exit 2017 was the year in which more central banks broke ranks. We expect this to continue in 2018. The Fed will hike four times and the BoC two, which supports long positions in USD and CAD. The loony is riding higher with oil prices. The correlation hasn’t always been there: during long months, domestic data from Canada as well as the ebb and flow of the greenback have shaped trading in USDCAD, leaving oil prices on the sidelines.

Well, we reckon fair value for USDCAD is closer to 1.20 and foresee a gradual move back towards that level as long as NAFTA survives and oil prices remain in their current range.

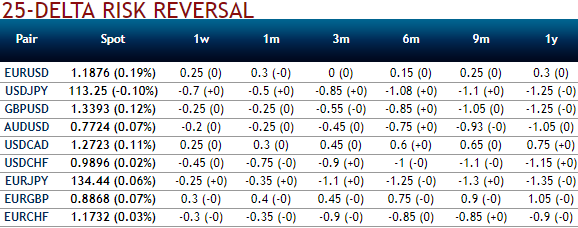

Thus, we advocate buying USDCAD 3m risk reversal strikes 1.3440/1.2450 (at spot ref: 1.2627 which is on track for our projection).

The recommended skews and risk reversal structure (refer above nutshells) takes direct advantage of the cheap skew opportunity.

It is expected that any CAD downside to be volatile, as it would likely be caused by geopolitical tensions and/or market unwind. This justifies owning topside convexity and volatility. Pure volatility investors may implement active delta-hedging to get direct exposure to the skew while getting rid of the directional risk. Given the downside risks attached to CAD appreciation, we would advise directional investors to implement a delta-hedging strategy involving a negative pre-defined mark-to-market threshold.

Elsewhere, EUR should benefit from the prospect of the ECB completing QE just as it rallied on the expectation of tapering this year. Buy EURUSD via optionality, as the underlying spot FX (EURUSD) won’t, in practice, be the best expression of the long euro trade. We prefer the NOK, SEK, PLN, and CZK. All and any of these are a medium-term buy against the US dollar or against the more vulnerable European currencies – the Sterling and Swiss franc.

We pair EUR vs NZD to neutralize the risk to EURUSD from a further repricing of the Fed. The RBNZ is an unlikely candidate to signal tighter policy as the slowdown in migration intensifies the downturn in housing and argues against a policy response to upside inflation risks from minimum wage increase etc.

The 3m window KO halves the premium compared to a digital call. In Sweden, the prospects of a policy pivot were delayed not derailed this year.

EURSEK is currently overshooting cyclicals by over 4% the most since 2010. The rebound in inflation to 2.0% in November reduces the risk of the central bank extending QE again next week (this was 0.3% ppt higher than the Riksbank's estimate), although it could still push back the lift-off point for rates by a quarter to 3Q18 in order to better align itself with the ECB’s extension of QE through September.

Long a 9m 1.80 EURNZD digital call with a 3m 1.80 window KO. Paid 17.5% on November 21. Marked at 19.04%.

Long a 6m 9.60 EUR put/SEK call. Paid 57.2bp November 21. Revalued at 52bp.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields