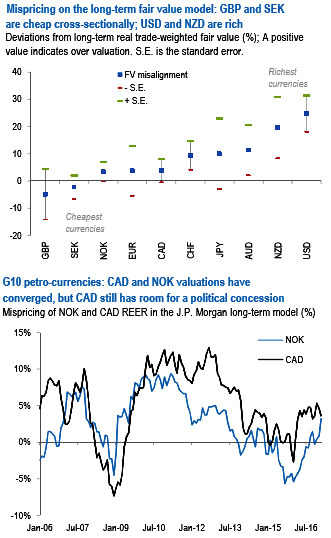

There is scope for more concession for political risk in European currencies. EUR still screens near fair value on this framework, indicating that there is room for further weakening if political risks intensify heading into the French elections. The richness in EUR continues to be similar to that in CHF on this framework, a gap we think should widen in favor of Swiss franc.

The dollar has strengthened across the board over the past month, keeping it as the richest currency on this framework. The outperformance of the dollar has come primarily at the expense of commodity currencies, but the overall ranking of these currencies hasn’t changed much in response. NZD and AUD continue to screen the richest on this framework, while the petrol currencies (NOK and CAD) are closer to fair value (refer above chart).

Scandis continue to offer value relative to most of the G10. SEK is still the second cheapest currency on this framework despite the outperformance over the month. NOK is modestly above fair value but still the third cheapest cross-sectionally and the cheapest within the G10 commodity currencies spectrum. NOK has richened modestly relative to CAD and are currently mispriced by a similar magnitude, which continues to indicate that there is a little NAFTA-related political concession in CAD (refer above chart).

Trades:

Long a 3-mo EURNOK 9.07 - 9.75 range binary, Short a 2-month 9.10 EUR put/SEK call, while short NZDSEK via vanilla puts.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data