Yellen dropped a heavy hint last week that a rate hike was coming on the Ides of March. That too is the day of the Dutch general election, though it remains unlikely that the populist Party for Freedom will secure a majority of parliamentary seats, especially with recent opinion polls indicating waning support.

US 10-year bond yields have traded to the top of this year’s range, and would need to break through to the upside to get the dollar’s momentum going. USD/JPY continues to be highly sensitive to US bond yields. Another decent US payrolls report this Friday should cement the emerging consensus of a March Fed hike.

After a month of relentless pounding, FX option markets are ending February with front-end vols in USD-pairs on a slightly firmer footing, thanks to what looks like a concerted campaign by Fed officials to nudge the market towards pricing in a March hike. That effort is largely successful judging by the climb in OIS-implied probability of a March move to 90%, but we suspect that markets will additionally test the odds of a rise in the 2017 median dot from the current three hikes to four in the run-up to the meeting.

Gamma in dollar pairs is likely to firm over the next two weeks with the Fed narrative returning as a market driver.

Owning USD-gamma in commodity FX funded with shorts in select yen crosses (EURJPY, CHFJPY) is a reasonable RV orientation.

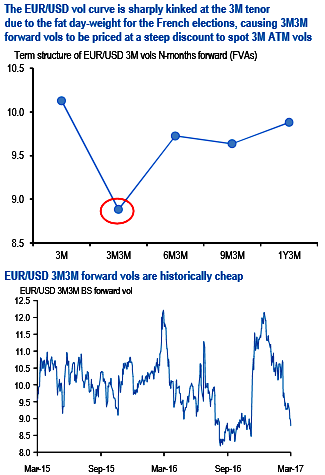

EURUSD 3M3MFVAs are asymmetric French election hedges given their steep discount to event premium-heavy 3M ATM vols and attractive entry levels. -3M/+6M calendar spreads of EUR calls/JPY puts are worth tracking as post-election reflation plays given vol curve inversion beyond 3M expiries.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms