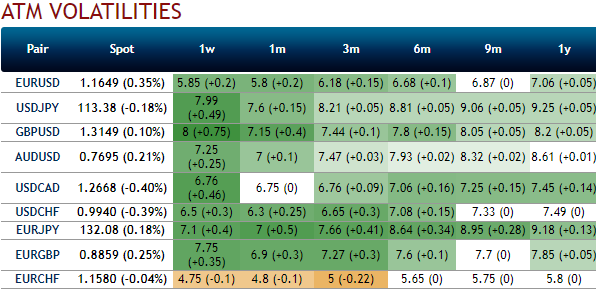

Let’s glance through the above nutshell that’s showing ATM IVs of G10 pairs which are lower side. Despite a mild pick up in IV rise, all the pairs are still displaying below 8% except USDJPY. This lackluster move is to be deemed as the options writers’ advantage.

Especially, USD rather lost its way in the recent past as Trump opted for continuity in the Fed chair, wage growth cooled to a near two year low, and the publication of the House tax bill did little to inform investors about:

1) The political compromises that will be necessary to pay for tax cuts, and

2) The probability and timeline for tax legislation to pass through Congress.

The Fed and tax were only ever bullish tail-risks for the dollar.

Nevertheless, the removal of uncertainty about the Fed chair and a greater sense of realism about the prospective fiscal/monetary policy mix in the US serve to neutralize the dollar’s immediate tactical prospects.

They also deal yet another blow to USD-based FX vols.

The VXY index of G10 FX volatility is approaching 7% -this is four points beneath the post-Trump peak, three points below its 20Y average, yet still two points above the hole that volatility disappeared into during 2014.

For good measure, the market is realizing even less volatility than the derisory amount VXY prices (delivered volatility of only 7.3% for G10 pairs over the past 3 months).

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures