JPY has been a middle-ranked but relatively weak currency within the G10 camp. Meanwhile, developments in the recent past:

1) An unexpected dovish turn by the Fed at the January FOMC resulting in a bearish view on USD,

2) The heightened concerns over the outlook of the global economy in favor of a bullish JPY view, and

3) The growing speculation that there will be upward pressure on JPY due to repatriations towards end-FY2018 (March 2019).

These factors, however, have likely supported the JPY bottom.

After a short-lived flash crash spike at the turn of the year, Yen vols have resumed their downtrend and are well on their way to testing their lows from 2Q’14 (refer 4th chart). The break of 8.0 on USDJPY 1Y ATM vol back in December had caused a frisson of excitement among vol accounts looking to buy Yen vega as a strategic late cycle FX vol play, but what was deemed to be a key technical support level has long since been left in the dust. 7.0 now looms as the next major target, beyond which there is still substantial room to fall to revisit pre-GFC levels in the 6s.

It is difficult to argue with option prices steadily softening when the spot is stuck in a tight 109-111 range and delivering 2-2.5 pts. below implieds.

There is also a case to be made that the ongoing softness in realized vols can continue longer than some anticipate, since the propensity of the Yen to rally in market downturns is being dampened by a cyclically wide US-Japan interest rate differential that is fuelling above-average equity and FDI outflows, alongside a reduction in FX hedge ratios of traditionally well-hedged foreign bond purchases.

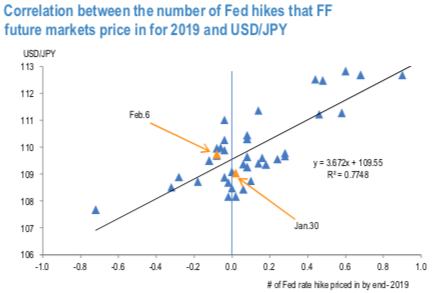

The number of Fed hikes that the FF future markets are pricing in for 2019 has continued to have a relatively strong correlation with USDJPY (refer 1stchart). FF future markets did not price in any hike even before the FOMC on January 30th.

The BoJ introduced a negative interest rate policy in end-January but this was

not sufficient to counter the deterioration in global risk sentiment. Also, it is worth noting that these developments led to the revision of the policy rate forecast at the March FOMC in 2016. Separately, Japanese investors net-sold foreign stocks and investments funds in April after entering into the new FY, following the global stock sell-off (refer 2nd chart). Meanwhile, Japanese investors remained net buyers of foreign bonds in this period— likely accompanied by JPY selling (refer 3rd chart). In 2018, JPY appreciated amid a rapid rise in VIX and global stock sell-offs in February and March. Japanese investment trusts also net-sold foreign stocks and investments funds in February and March, which might have contributed to the acceleration in JPY appreciation. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index was at 49 (which is bullish), while hourly JPY spot index was at 29 (bullish) at 07:18 GMT.

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal