It has taken a monumental VIX shock for the realization to dawn that the low volatility patch of 2017 is now history. Front-end FX vols had been climbing for the better part of the new year on heavy demand for USD puts and firm realized vol due to swift dollar declines, but did not grab nearly as much attention as this week's moves because it qualified what one might term as 'good vol' -the sort that aids returns by accelerating the market in the direction of core investments.

That endorphin rush was rudely stopped in its track this week by the return of gravity to equity markets, in the process turning good vol into bad and forcing a re-assessment of the risk/VaR regime that investment programs are operating on even if macro fundamentals are widely considered to be constructive.

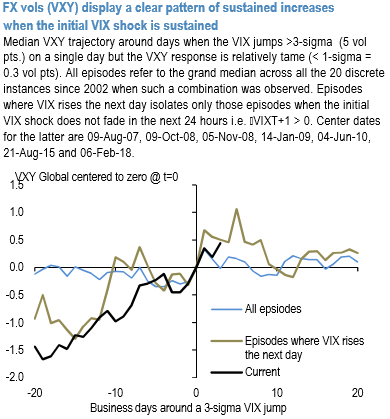

VXY has now climbed more than 2% pts. off the dead lows of early January –a third of that this week alone –after an initial sluggish response to the equity shock. This is par for the course. FX vols tend to react to VIX spikes with a modest lag of a day or two that it takes for natural contagion channels to activate but thereafter tends to last for 1-2 weeks; the current episode is unfolding almost exactly along historical lines which suggests it is too early to rush in to fade the spike (chart 1).

What about valuations? The sharp rally of the past two days has eliminated the longstanding cheapness of FX vols to macro correlates. Our workhorse model for FX vol constructed with a global business cycle variable (JPM global PMI), a proxy for growth surprises (rolling 12m std. deviation of global PMI) and a forecast uncertainty indicator shows that VXY Global @ 8.9 is at fair value (chart 2).

While an encouraging sign for would-be vol sellers, we caution against attempting to fade these moves immediately since mean-reversion from extreme model undershoot in this cycle is unfolding tick-for-tick in line with historical priors and has another 3-6 months to run before plateauing at a permanently higher level (chart 3). Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand