A day ahead at a glance EURUSD broke above 1.16 last week, it may be 1.18 come to the next ECB meeting in September. US interest rates rose slightly while the USD consolidated near a one-year low. There was little news to drive markets.

Wednesday’s FOMC meeting is the highlight of the calendar this week and while our baseline is for no change, recent rhetoric suggests a chance that an announcement on balance sheet reduction could come this week.

Given the current mood, however, there is no guarantee that such a decision would support the greenback; markets may simply perceive this as the dovish alternative to an actual rate hike.

The main focus of attention for the day has been IFO survey, that has produced upbeat numbers (actual 116 versus f/c 114.9 and previous 115.2) providing a further update on the German economy.

This follows yesterday's ‘flash’ PMI data for July, with German manufacturing and services PMI’s slipping to their lowest level since April and February respectively.

Amid a mild bearish sentiment of EURUSD today, it remained above 1.1650 during European trading sessions, likely to edge towards 2-years highs of 1.1714 levels. This has already been very well anticipated as the next semester should see the euro break above its range of the last few years, and interest rate volatility fueled by central banks exiting accommodation will be channeled towards FX.

Data schedules:

July 26: Australia 2Q CPI, UK 2Q GDP, US new home sales, and FOMC meeting.

July 27: US durable goods orders.

July 28: Japan CPI, France 2Q GDP, France CPI, Sweden 2Q GDP, Germany CPI, Canada May GDP, and US 2Q GDP.

OTC updates:

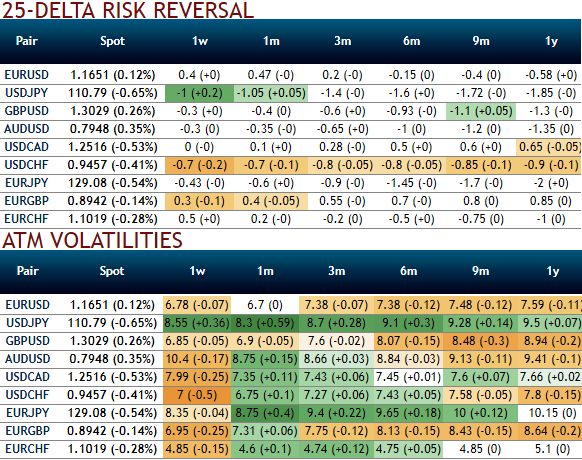

Please be noted that despite above-mentioned data events, EURUSD IVs are shrinking away with neutral shifts in risk reversals, while 1-3m RR has currently turned into positive flashes to mitigate bullish risk sentiments, while the 3m and 1y are lower than one vol for EUR puts. Crossing the line whereby euro calls become more expensive than puts may not be that far away. While the positively skewed IVs of 1m tenors signify upside risks of the underlying pair.

EURUSD risk reversals, in the recent past, have flipped onto calls from puts. A positive RR means that the euro tend to appreciate faster than it falls, reflecting the durable positive correlation between the dollar’s level and its volatility.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom