ETHUSD surged more than $150 in the past 24 hours on positive market sentiment. It hit a high of $3369 at the time of writing and is currently trading around $3230.

According to saniment data, ETH profit/loss ratio to 2.3/1 for coins in three months compared to 1.8/1 for BTC. The recent Dencun upgrade also supports ETH at lower levels.

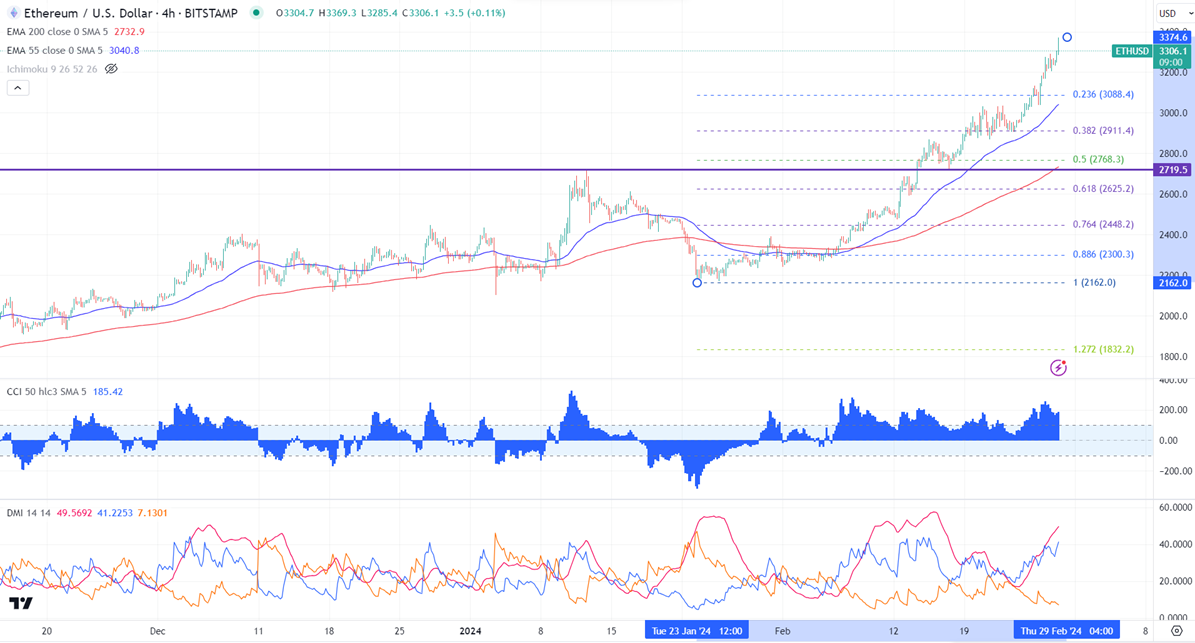

The intraday bullishness is possible if it holds above $3375. On the higher side, the near-term resistance is $3375. Any significant jump above the target of $3550/$4000. Significant bullish continuation only above $3555.

The immediate support is around $3200. Any intraday break below will drag the pair to $3080/$2975/$2870. Any breach below $2700 confirms bearish continuation. A dip to $2500/$2470 is possible. A violation below $2100 will drag the Ethereum to $1870.

It is good to buy on dips around $3245-50 with SL around $3000 for TP of $4000.