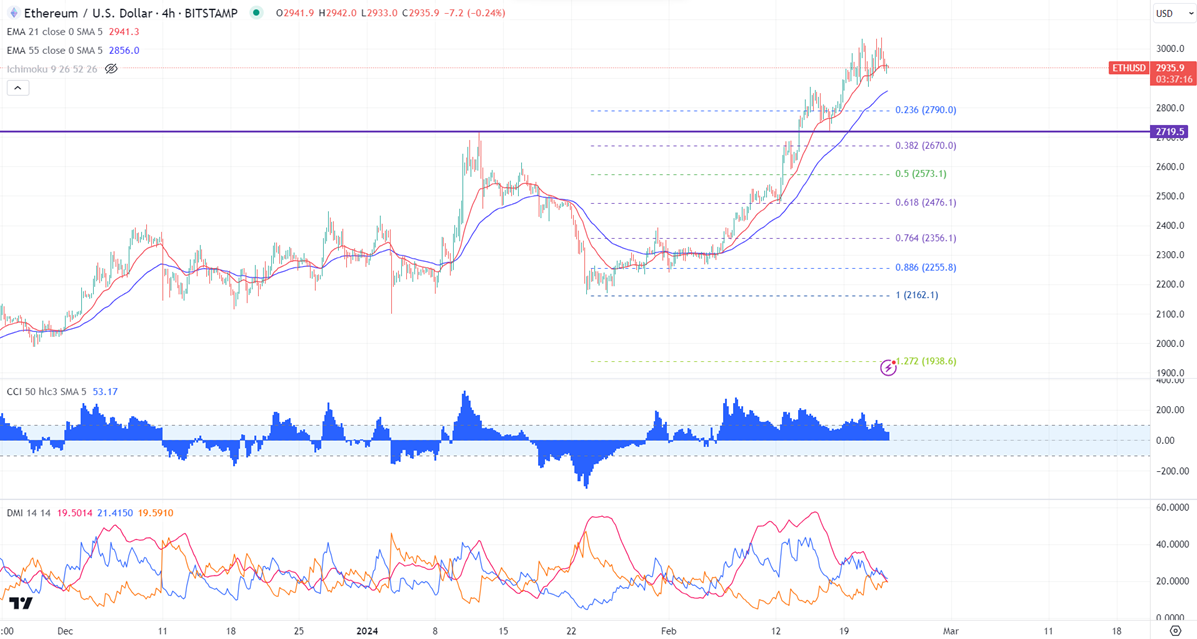

ETHUSD showed a minor sell-off due to profit booking. It hit a low of $2907 yesterday and is currently trading around $2936.50.

According to data from into the block shows that 1.38M addresses bought 1.33M $ETH at an average price of $2984. 4 whales sold $34134 ETH near the $3000 price.

The intraday bullishness can be seen if it closes above $3000. On the higher side, the near-term resistance is $3000. Any significant jump above the target of $3200/$35550. Significant bullish continuation only above $3555.

The immediate support is around $2870. Any intraday break below will drag the pair to $2800/$2725/2670/$2575/$2500. Any breach below $2470 confirms bearish continuation. A dip to $ 2400/$ 2350 is possible. A violation below $2100 will drag the Ethereum to $1870.

It is good to buy on dips around $2840-45 with SL around $2700 for TP of $3500.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary