The implied volatilities of ATM contracts of this the pair are flashing at around 9.15% for 1w expiries and above 10% across longer tenors.

Delta risk reversals negative ticks signify the hedging positions are well equipped for downside risks over the longer period of time.

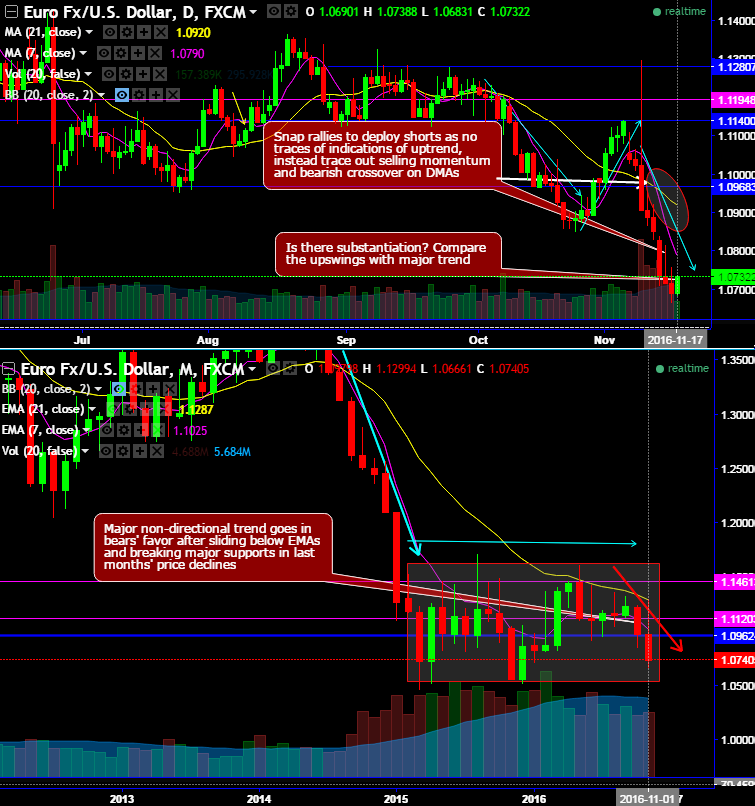

From almost last one year we've been seeing the pair oscillating within stiff sideway trend (ranging 1.1480 to 1.05 levels).

For today, after a long lasting flurry of bearish effects, the pair has surged to 1.0711 (compare this with the strikes of 1.0890 in contracts expiring on next Wednesday in mkt pinned risk), Wednesday’s 11-month trough of 1.06651 as dollar losing traction today, however, remained closer to the multi-year highs.

If you consider long term euro's valuations then you would come across the convergence between spot curve, market pinned risk and risk reversals (see spot/market pinned risk/risk reversal relation in the diagram).

The FxWirePro’s weighted average dollar spot index that measures hourly performances of the dollar against a basket of 7 currencies, the USD has been fluctuating during the course of the day but gaining the traction for upside again ahead of today’s data streaks of economic data and the speech by Federal Reserve Governor Janet Yellen.

As you can see in the chart, we are close to major support levels, with the USD trade-weighted index heading toward range lows.

We have divergence developing in the intra-day studies now and as such a greater risk of a correction in the near-term from these levels.

US rates have paused for the last few days too, suggesting the USD may have got a little ahead of itself. 1.0840 is intra-day resistance, while a move through 1.0930-1.0975 is needed to do damage to the current bear trend.

Ultimately we have been open to the entire contracting range since March 2015 as a consolidation within the long-term bear trend. We are therefore on high alert for a breakdown through the key 1.0600-1.0450 lows, opening a potential move towards parity.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields