FX analysts expected the Federal Reserve to hike rates more aggressively than what was priced in by investors, leading to a higher expected path for short term rates over the coming 10 years (Fed is scheduled for its monetary policy for next week, consensus - hike of 25 bps). As the Fed had begun selling their holdings of Treasuries, supply was expected to increase relative to demand, leading to higher yields through a higher term premium, that is, the difference between long-term rates and the expected path for short term rates over the same period. This is usually seen as the compensation required by investors to invest in long-term rather than short-term assets.

The Fed is likely to end its rate hike cycle in 2019. That still leaves a considerable yield advantage for the dollar against the euro – in particular if one (like us) assumes that the ECB will not be hiking interest rates next year.

However, the greenback’s rate advantage is unlikely to lead to permanent USD appreciation. On the contrary: the end of the Fed rate hike cycle is likely to have a negative effect on the dollar.

EURUSD prices remain in the contracting range. These patterns are generally viewed as consolidation phases within the underlying trend. As such, the bias is still for an eventual test down to and through the 1.1215 previous lows. However, a move up through 1.1450 and then 1.1500 would negate the pattern and suggest a more optimistic outlook in the short-term, and a return to the previous range around 1.1600. We would still need more evidence that 1.1215 is the major higher low we are looking for.

On the medium-term perspective, we view 1.12-1.08 as a major support region and the ideal area for a long-term higher low over the 1.0340 lows set in 2016. Notable supports within this region lie at 1.1190 and 1.1000. Further evidence is needed to prove that 1.1215 was the higher low we are looking for.

FX Derivatives Strategy: Options Strips

Combination ratio: (2:1)

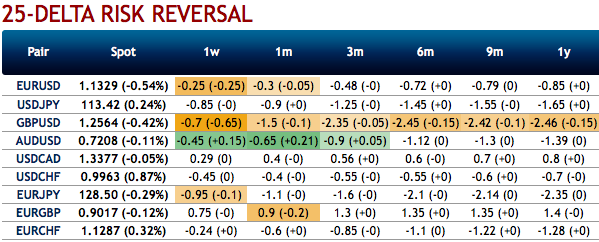

Rationale: Considering the bullish (in near-term) and bearish technical environment (in long-term) and most importantly, the positively skewed IVs in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers.

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 2M tenors, go long 1m at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside.

Alternatively, shorting futures of mid-month tenors are advocated with a view of arresting further potential slumps. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -23 levels (which is mildly bullish), while hourly USD spot index was at 45 (bullish) while articulating (at 13:45 GMT).

For more details on the index, please refer below weblink:

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed