The ECB press conference on last Thursday will serve to show what tightrope act the central bank now faces. It has to end its bond purchases without having achieved the targets aimed at with the buying program. But solid economic growth should come to its rescue.

The USD remains weak, thanks to the US inflation data released on Friday. Against these backgrounds, we see some upward risks for the EURUSD exchange rate this week if Draghi gives only the slightest indication towards an exit from the loose monetary policy.

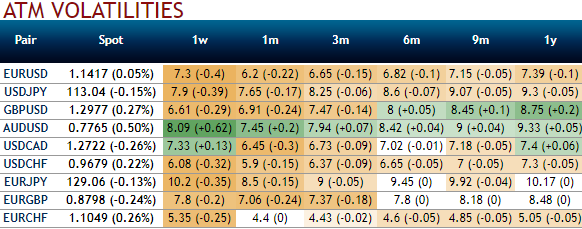

We are trading EURUSD tactically given the Fed outlook and own EURJPY as the best expression of global rates rethink that the Bank of Japan would be the last to embrace. The Fed has been noncommittal while the ECB continues to guide markets towards QE taper. Initiate long EURUSD to neutralize implicit EUR short via DXY. EURUSD volatility remains depressed, but the euro appreciation that we expect is likely to be turbulent. In the process, the skew could flip in favor of EUR calls for the first time since 2009.

The next semester should see the euro break above its range of the last few years, and interest rate volatility fueled by central banks exiting accommodation will be channeled towards FX. Buy 6m EURUSD calls conditioned by higher volatility.

EURUSD volatility remains depressed, but the euro appreciation that we expect is likely to be turbulent. Vanishing political risk killed FX volatility, but next semester should see the euro break above its range of the last few years.

Interest rate volatility fuelled by central banks exiting accommodation will be channelled towards FX.

In the process, the IV skew could flip in favor of EUR calls for the first time since 2009.

EA strong capital surplus and the ECB withdrawing from QE are strong forces that may propel the euro much higher than our 2018 forecasts. Buy EURUSD 2y OTM calls financed by selling the bottom of the range via expensive puts.

Towards the top of the EURUSD range: Stay long in EURUSD via 6m call strike 1.15, European KI on the realized volatility at 9% Indicative offer: 0.60% (vanilla: 1.61%, volatility swap: 7.6%, spot ref: 1.1443).

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.