Bearish EURUSD scenarios:

1) Eventual repatriation by US corporates-EUR accounts for a third of foreign profits.

2) EUR appreciation delays ECB policy normalization (change in QE guidance delayed until April).

3) MS5 government in Italy or renewed elections.

4) Growth relapses to 2.0-2.5%.

Bullish EURUSD scenarios:

1) The ECB changes guidance in March, heralding an end to QE in Sept and hikes by 1Q’19.

2) Growth sustains above 3% into 2H’18.

3) Concerns about the US twin-deficit intensify.

OTC Outlook and Options Strategy (EURUSD):

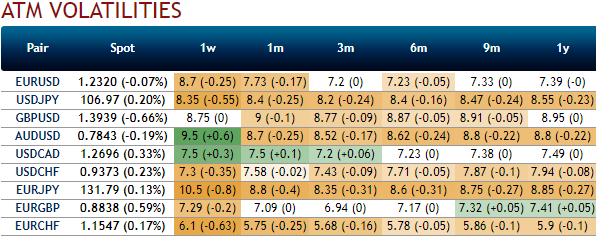

Please be noted that the above nutshell showing 3m IVs of this pair, that has been neutral. Implied volatilities have been extremely lower among the G7 FX space and you could also make out that there have been no hedging sentiments (neutral risk reversals in the same tenors and with the positive shift in bearish hedging sentiments in 1m-3m tenors).

Well, contemplating these OTC indications, using collar spread options strategy, the investor gets to earn a premium on writing overpriced calls capitalizing on lower IVs, simultaneously add a protective at the money put option bidding negative RRs.

This is a suitable strategy where the moderately bullish investor sells out of the money calls against a holding of the underlying spot outrights but keeps downside risks on the check.

Buying ITM call options gives you high positive delta, unlimited profit potential, and therefore if you are expecting the underlying FX pair to spike up ascetically with the possibility of going much higher, you would buy ITM calls.

On the flip side, shorting OTM puts fetches you a certain return but limited profit potential as long as the underlying spot FX remain above the strike price so if you are expecting the underlying pair to remain more or less sideways or upwards just a little bit, you would do this instead.

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above -23 levels (which is bearish). While hourly USD spot index was inching towards 118 (highly bullish ahead of today’s prel.GDP data announcement) while articulating (at 12:15 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand