Last week euro and sterling surged vigorously against the US dollar at close to five-month highs. It has slipped modestly this morning but remains close to the top of its recent trading ranges as it waits for further developments in Westminster. Meanwhile, the US dollar continued to slip against the euro last week. Markets now put close to a 90% probability on a third consecutive US rate cut at the Fed meeting on 30thOctober.

The calendar for the rest of this week is also sparse with only relatively second tier data releases in the UK and the US. The October Eurozone PMIs (Thu) and German IFO (Fri) will be of more interest and they are expected to show continued modest economic growth.

Beyond Brexit, the coming week will be notable for Draghi’s swansong at the ECB. But the final Governing Council meeting under his stewardship, to conclude on Thursday, will be inconsequential for policy. Data-wise, the highlights will be the euro area flash PMIs, also on Thursday, as well as the US durable goods report due the same day.

The September meeting of the ECB Governing Council saw the central bank move back on to a clear policy loosening path. The deposit rate was cut by 10bps from –0.4% to –0.5%, in line with market expectations. Meantime, the ECB also indicated that it would restart it QE asset purchase programme in November. Total purchases will be relatively modest at €20bn per month. However, the ECB indicated that the purchases would run for as long as necessary.

OTC Updates:

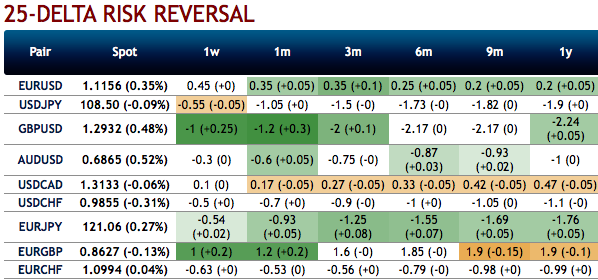

The FX OTC hedging markets are also suggesting the same thing, the IVs and risk reversals of the short tenors indicate interim rallies but the major bearish hedging sentiment remain intact.

3m skews are stretched on either side (equal interest in both OTM call and OTM puts), 3m positively skewed IVs have still been signalling downside risks and upside risks as well. Skews stretched towards OTM put strikes signifies hedgers interest in the further bearish risks in the major downtrend.

To substantiate these indications, positive risk reversal numbers (RRs) across all tenors are observed, which is in line with the above-stated hedging scenarios.

All these indications coupled with the fundamental factors and the underlying scenarios are attractively appealing ITM put holders. Contemplating all these factors, we advocate below options strategy.

The interim upswings likely to prolong but the sustenance seems dubious in the long-run. So, it unwise to ignore the bearish stance in the major downtrend which is emphasized even in our technical section as well.

Hedging Strategies: At spot reference: 1.1175 level, initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write an (1%) out of the money put option of 2w tenors.

Those who are sceptic about mild rallies, 3m 1% in the money puts with attractive delta are advised on a hedging ground. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

Alternatively, we advocate initiating longs in EURUSD futures contracts of October’19 delivery as further upside risks are foreseen and simultaneously, shorts in futures of November’19 delivery for the major downtrend. Thereby, one can directionally position in their FX exposures on hedging grounds. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: Sentrix & Saxobank

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand