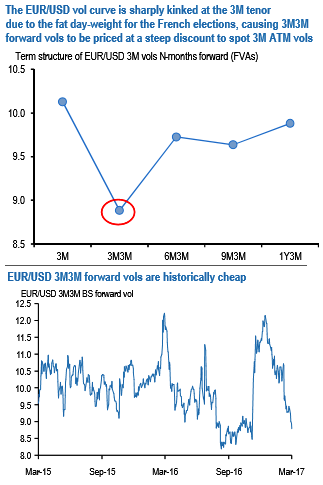

The European election-distorted EUR/EUR-cross vol curves: The risk premium for the French elections has distorted EUR-and EUR-cross vol surfaces. 3M-1M vol curves have steepened enormously due to the boost to 3M expiries from the fat day-weight associated with the second round vote on May 7th; post-3M vol curve segments are inverted however as the event effect fades in longer tenors (refer above chart).

The inversion of the 6M-3M segment and the resulting steep discount of 3M3M forward volatility (FVAs) to 3M ATMs has sparked interest in buying EURUSD 3M3M FVAs as an asymmetric election hedge at levels that appear historically favorable, especially after the sharp sell-off in vols this week (refer above chart).

It seems instinctive enough that 3M3M forward vol should deliver substantial positive returns in the event of an unexpected Le Penn victory, yet the dynamics of implied vols around a binary event can be a little murky since the shock of a tail outcome intersects with the offsetting effect of implied vols collapsing as a large day-weight rolls off the option expiry window (note: no such conflict with realized vols/gamma which explode when spot reacts violently to a shock result). Where this tension eventually re-sets implied vols after the event is difficult to quantify ex-ante, but we can at least look back at the two major political disruptions last year to judge how much merit there was in buying FVAs.

We examine the performance of 3M3M FVAs in GBPUSD around the Brexit referendum and USDMXN around the US elections initiated 2-months prior to event dates, roughly the time-to-event in the current instance. Initial conditions in terms of vol levels and curve slopes are not strictly comparable across episodes, but the consistency of outcomes across the (grand sample size of) two episodes is comforting.

Two key takeaways from chart 6 are: (a) in both cases, FVAs delivered 2.3-2.8 vols of peak P/L on mids and are able to monetize nearly the entire ex-ante static slide along the term structure, meaning that ATM vols do not roll down at all after a left tail outcome despite the passage of event risk; and (b) optimal entry timing into FVAs is 4-5 weeks before D-day when the pricing of event.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings