We’ve already advocated call reverse knock out spreads for EURJPY as the underlying spot FX seemed to have been exhausted. Consequently, we’ve seen bearish effects in the recent past.

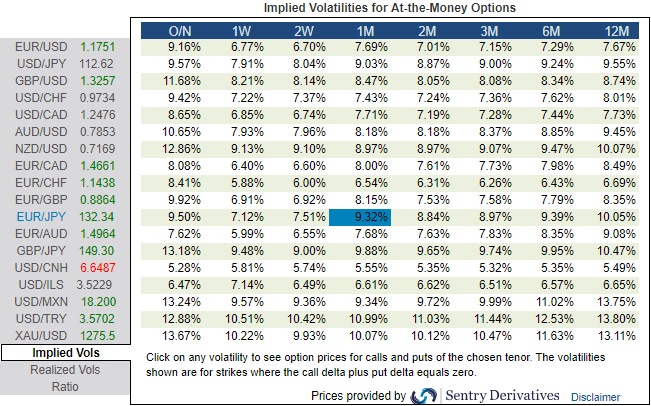

Please be noted that the implied vols of EURJPY crosses have been shrinking lower from the current 9.5% to 9.32% for 1m and 8.84% for 2m tenors in spite of the speech of ECB’s Draghi.

Positively skewed EUR vols and bearish neutral risk reversals have been shrinking to the lower level. Also, in longer tails, the EUR volatility smile remains flat compared with the rates vs vol correlation seen since 2015 and over the past week.

The steepness of the EURJPY risk-reversal curve renders back-end tenors better shorts, risk reversals have been bearish neutral. While positively skewed IVs towards OTM put strikes signifies hedgers’ bearish sentiments but puzzles prevailing uptrend of euro. The major trend has been in the consolidation phase that manages to break-out above 50% Fibonacci retracements and hit 61.8% levels from the lows of 109.5350 levels. For now, the trend has been little edgy as the bears have hampered momentum.

However, we prefer sticking to 2017 expiries (6M) since 2018 dates come with unpredictable Italian election risk. The EUR/gold risk-reversal curve is much flatter in comparison hence short tenors work fine. We enter short 6M 25D EURJPY risk-reversals (delta-hedged).

Contemplating above rationale, we could foresee more upside traction in spot prices amid minor hic-ups, thus, we advocate upholding the prevailing bullish exposure in EURJPY via a call RKO as JPY weakening is likely to be a slow grind rather than explosive.

Sell 6M EURJPY 25D IVs and risk-reversal (buy EUR calls - sell EUR puts), delta-hedged.

Vol pts Positive smile theta participation in Euro bull-trend.

The macro theme of euro area leading outperformance remains dominant; maintain core EUR or proxy longs as growth and inflation data continue to be supportive. Accordingly, encourage long EUR vs in cash (vs USD) and through options in EURJPY (131.500 call, RKO 135.25).

Any spot holdings, wise to book returns in long EURJPY cash; but stay long EURJPY in options structure.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing -34 (mildly bearish), while hourly JPY spot index was at 84 (bullish) while articulating. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate