As the ECB edges towards normalization, an undervalued euro has room to rise further, we could foresee bullish scenarios for euro, given that the ECB changes guidance today, heralding an end to QE in Sept and hikes by 1Q’19.

All hawks eyes are on when will the ECB end its QE programme? For now, the QE programme seems constructive for EUR and is likely to be one of the reasons as to why the European single currency is largely trading at robust levels.

EURGBP trades a relatively narrow 0.8689 to 0.9032 range through the latter stages of Q4 of 2017. However, the rally through this upper pivot resistance level has increased our conviction for a move towards the 0.8950-0.9025 range highs. Medium-term momentum is positive and has room to extend.

The above fundamental factors are priced-in OTC functions. Let’s glance on sensitivity tool, the bullish neutral risks reversals that indicate the bullish risks in underlying spot FX prices remain intact.

While the positively skewed IVs of 3m tenors coupled with bullish neutral RRs across all tenors signifies the interests of OTM call strikes that means the ATM calls have higher likelihood of expiring in-the-money, while balanced hedging sentiments on either side in shorter tenors (see skews of 2w expiries) that are favourable to both call and put options holders’ advantages.

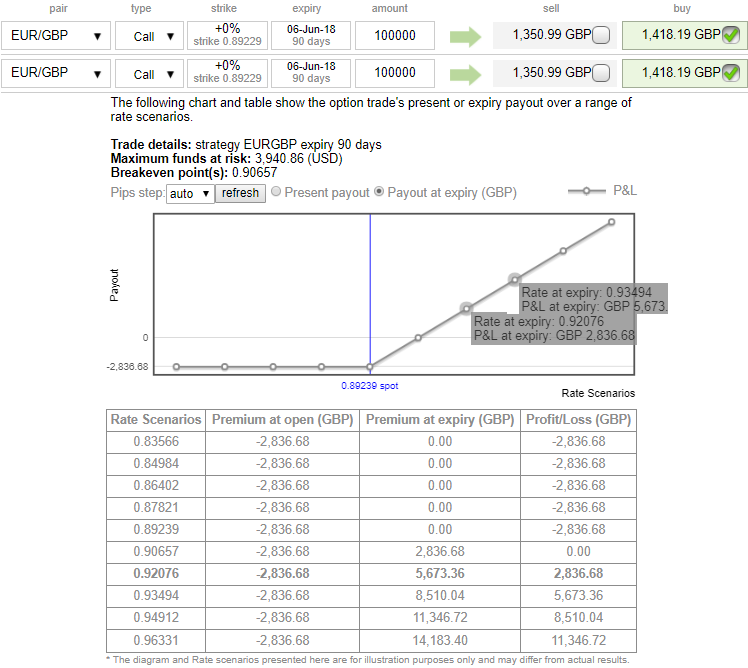

Hence, in order to arrest both upside risk that is lingering in intermediate and major trend, on the flip side, declining trend in short run, we recommend diagonal option strap strategy.

Thus, initiate long positions in 2 lots of 3M ATM 0.51 delta calls and simultaneously, 1 lot of ATM -0.49 delta puts of 2w expiries, these options positions construct smart hedging and trading base at net debit.

The strategy is likely to mitigate both bullish as well as bearish risks irrespective of spot moves. However, on speculative grounds, more potential is foreseen on the upside. Please note positive cashflows whether underlying spot keeps flying or dipping.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 92 (which is bullish ahead of ECB monetary policy meeting today), while hourly GBP spot index was at 119 (bullish) while articulating at 08:22 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom